by SA’s ridiculous wind power ‘policy’

****

To call what South Australia’s Labor government has ‘gifted’ their constituents an energy ‘policy’, is to flatter it as involving some kind of genuine ‘design’. It’s an economic debacle, pure and simple.

The current mess started under former Premier, Mike Rann – a former spin-doctor, whose relatives lined up at the wind power subsidy trough from the get-go.

Under its current vapid leader, Jay Weatherill, SA’s Labor government has been talking up a wind powered future for months now; swanning off to Labor’s fantasy world, where the wind blows and the sun shines 24 x 365; and the power is, of course, totally “free” – with his claims that SA can ‘enjoy’ more than 50% of its power from the sun and the wind, with just a little (more) government “help”.

Back in ‘harsh reality land’, however, Jay’s presiding over the worst unemployment in the Nation, at 8% – and soon to rocket – worse still than perpetual basket case, Tasmania

Most, gifted with the slightest grip on the basics of economics, pick up on the fact that producers of widgets (and the like) are driven by profits (a motive lost on Labor/Green apparatchiks), which, in turn depend upon input costs. For widget makers, butchers, bakers and the like, drive up input costs and, all things equal, their profits will fall; and their ability to invest in their business and employ people will drop off, too.

Where the item is high on the list of inputs, a jump in its cost may see that business, or even whole industries, collapse; as they end up insolvent.

As just the most glaring example, where the input is electricity, industries that use stacks of it – like manufacturers, miners and mineral processors – have been literally crushed, as power prices have skyrocketed; thanks to wind power subsidies and the additional and unnecessary costs of peaking power to back it up when it disappears every day:

Britain’s Economic Nightmare Unfolds: Wind Power Costs Killing Thousands of REAL Jobs

South Australia’s economic debacle is, in no small part, due to its diabolical wind power policy; that’s led to South Australians paying the highest power costs in the Nation – if not (on a purchasing power parity basis) the highest in the world.

The fact that SA is an economic train wreck (see our posts here and here) is clearly lost on the likes of Jay Weatherill, Gail Gago & Co, when they start talking about a “transition from the old economy to the new economy” – a place where, apparently, the rules of economics are permanently suspended, with skyrocketing power prices having no effect on investment, growth in incomes or employment. Maybe Weatherill & Co’s heralded “new economy” runs on moonbeams and fairy dust?

It’s going to need to – SA ‘relies’ on 17 wind farms and their ‘notional’ installed capacity of 1,477MW. However, its faith in the Wind Gods, pixies and the like seems to disappoint more than deliver – here’s the chaos delivered in November – which we will return to in more detail below:

A few weeks back, we covered the same dismal theme in our post – Wind Power Disaster Unfolds: SA Facing Total Blackouts, Rocketing Power Prices & Thousands More Chopped from the Grid – in which we drew on a pretty decent piece of work by the Australian Financial Review’s Ben Potter.

Ben stands head-and-shoulders above the run-of-the-mill hacks from the struggling Fairfax stable; and (unlike Peter Hannam) appears to shun their standard issue rose tinted specs, when it comes to facing up to the unassailable fact that wind power is, and will always be, meaningless as a power generation source.

In Ben’s previous piece he threw light on the cold, hard fact that South Australia, aka ‘Australia’s wind power capital’, can look forward to regular, mass blackouts – thanks to its ridiculous attempt to rely on a power generation source that can only ever be delivered at crazy, random intervals; if at all.

Well, Ben’s back with another cracking little piece, that throws the spotlight where it’s needed: namely, squarely focused on the insane cost of the greatest energy debacle in the history of the Commonwealth.

Under the adage that a picture’s worth a thousand words, we’ve added a few, where Ben starts quoting wind power output figures for SA – courtesy of the boys over at Aneroid Energy.

Once again, Ben puts in a very solid effort. However, he pulls one or two clangers – which we’ll fix up along the way [STT’s observations and comments are indented in square brackets]. Otherwise, Ben hardly puts a foot wrong.

SA green energy policy comes at a heavy cost

Australian Financial Review

Ben Potter

14 December 2015

Five weeks ago, on a Tuesday, strong winds spun South Australia’s wind turbines flat out, meeting most of the state’s electricity needs and giving industry some of the cheapest energy in the land.

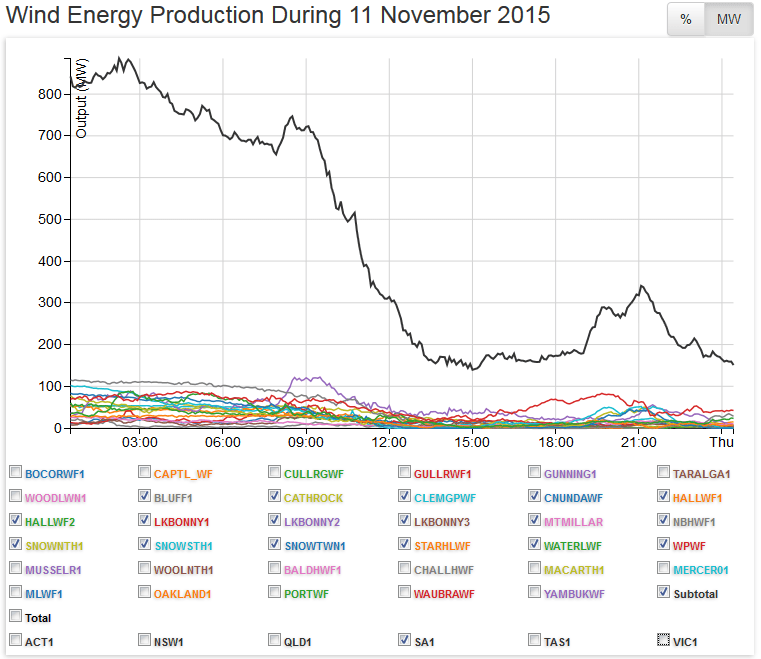

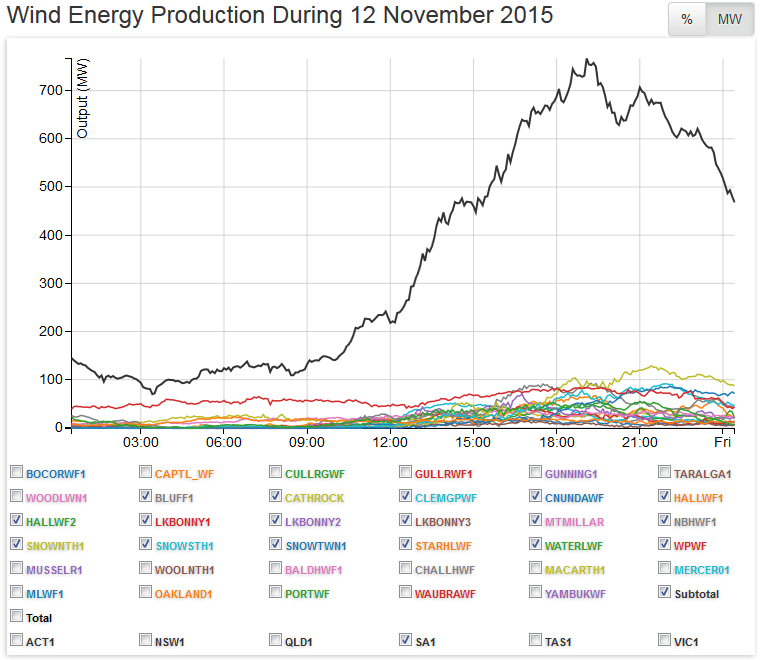

At times the price dropped below zero. But on Wednesday [11 November – see below] and Thursday [12 November – see below] the wind suddenly abated, and the turbines ground to a lazy halt. Wind energy production dropped to a fraction of demand, and the high voltage interconnector to Victoria’s brown coal power – the usual standby – cut out too.

That brought tightly held local coal and gas-fired power back into the mix, forcing the wholesale price up to about $2400 a megawatt hour at lunchtime on both days.

Extreme price volatility in South Australia’s isolated electricity market is usually short lived, but it is pushing up contract electricity prices permanently.

Industrial energy buyers are guinea pigs in SA’s bold experiment in leading the nation in expanding use of renewable energy that depends on the wind blowing and the sun shining. It’s a harbinger of a future in which other states are set to ramp up their wind and solar generation, a path the world is being urged to take at the Paris climate talks.

Futures contracts on the ASX Energy market for electricity delivered in 2016-18 are between $86 and $90 a MWh in South Australia, compared with between just $37 and $41 MWh in Victoria and between $43 and $48 a MWh in NSW.

That’s a big problem for Nyrstar, the Dutch group redeveloping the Port Pirie lead smelter in a $563 million project underwritten by South Australian taxpayers, which is in the market for more power.

“Electricity in particular represents a very significant part of Nyrstar’s production costs and any increase in the price thereof could increase Nyrstar’s costs and reduce its margins”, harming its business and financial condition, said Bertus de Villiers Nyrstar’s head of metals refining at Port Pirie.

South Australia’s wind generators produced 30 per cent of its energy needs in 2014-15, a point of pride for the state’s Premier, Jay Weatherill. Wind and solar capacity combined reached 38 per cent.

But this is “already challenging the sustainability of the of the SA system”, said Deloitte Access Economics in a report for the EnergySupply Association of Australia published last week and disputed by wind generators.

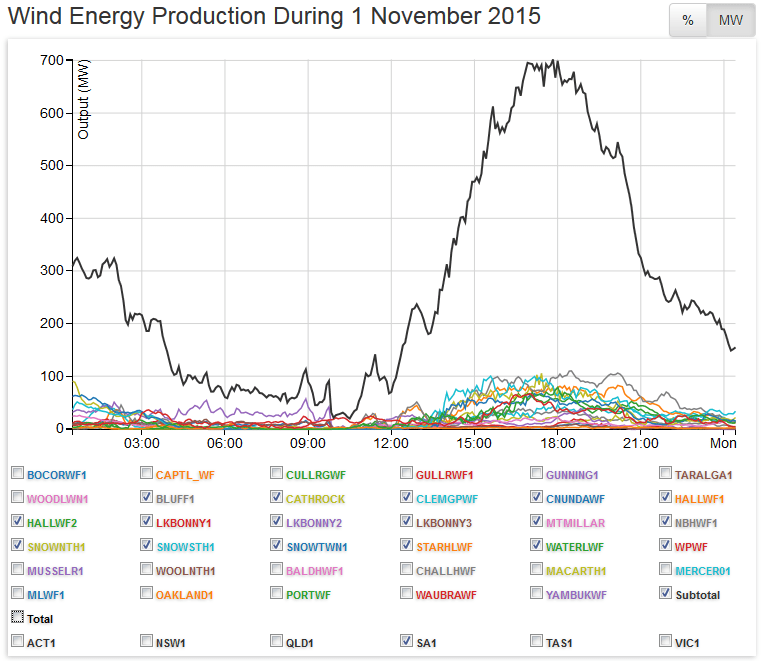

Another episode on Sunday, November 1, coincided with the interconnector with Victoria tripping as it was undergoing an urgent upgrade.

[Ben almost nails the culprit on 1 November, as he says below, the spot price rocketed, as wind power output collapsed: output plummeted from 700 MW (a burst lasting less than 60 minutes) to around 150 MW by midnight; an interconnector killing drop in output of 550 MW, over a span of less than three hours. With the most rapid drop of 250 MW seen in the 20 minutes before 9pm; and a further 150 MW drop from that point to midnight. The result was that the interconnector Ben talks about ‘tripping’, did so automatically to prevent thermal self-destruction. The load on the interconnector exponentially increased beyond its capacity, as wind power output collapsed – the result was a statewide, mass blackout from around 10pm that Sunday night: Wind Industry’s Armageddon: Wind Farm Output Collapse Leaves 110,000 South Australian Homes & Businesses Powerless]

That pushed the electricity price close to $2000 and the price of “Frequency Control and Ancillary Services” (FCAS) – which help keep frequency and voltage within safe limits – as high as $6500 per MWh from a typical $1.

On several other occasions from July to October prices have exceeded $10,000 MWh and hit the National Electricity Market’s $1380 MWh maximum.

[For more detail on wind power collapses driving spot prices through the roof: South Australia’s Unbridled Wind Power Insanity: Wind Power Collapses see Spot Prices Rocket from $70 to $13,800 per MWh]

By contrast the sub-zero prices that can occur when the wind is howling are only sustainable for wind and solar generators because they get extra payments outside the market under the Renewable Energy Target.

Volatility and instability in South Australia’s grid are set to worsen next year. About 1250 MW of coal and gas generation is due to be withdrawn from the market, leaving the state even more heavily reliant on wind, solar and the interconnector with Victoria’s brown coal generators.

Other markets with high renewables shares such as Denmark, Iowa and Germany are more solidly interconnected with neighbouring nuclear and fossil-fuel baseload generators.

[Not so, Ben. Because it has no market for it – there is nothing like the grid capacity to take it from North to South – Germany has been attempting to force excess wind power onto its neighbours: its Czech, Polish, Dutch, Belgian and French neighbours’ grids are being swamped with excess power – whenever the wind picks up in Germany’s North – resulting in grid instability and blackouts: Germany’s Wind Power Surges Plunge Their Neighbours Into Darkness]

Britain has introduced a capacity market – which pays baseload suppliers to ensure supply – and Germany is mulling a variant of the policy which critics say just perpetuates fossil fuels. South Australia’s interconnector to Victoria covers only 23 per cent of its needs.

Wind and solar energy are virtually free of carbon dioxide emissions.

[Not so, Ben. Properly accounting for CO2 emissions in the electricity sector requires adding the additional CO2 emissions burnt by coal/gas steam plants keeping spinning reserve, whereby coal and gas is burnt to keep turbines spinning without sending power to the grid. This is essential to prevent the grid from collapsing when wind power output plummets without warning (see above). And the gas back-up Ben talks about, comes from highly inefficient Open Cycle Gas Turbines, which emit 3-4 times the amount of CO2/MWh generated, when compared to a modern coal-fired plant. For more see: Why Intermittent Wind Power Increases CO2 Emissions in the Electricity Sector]

Once the plant is built the marginal cost of the energy is negligible, enabling renewable generators to clean up in the National Electricity Market, forcing wholesale prices down and pushing coal and gas to the sidelines or out of business.

[Not entirely so, Ben. What allows them to ‘clean up’, is the threat placed on retailers of the $65 per MWh shortfall charge: What Kills the Australian Wind Industry: A $45 Billion Federal Power Tax. It’s either pay the fine (the real cost of which to retailers is $93 per MWh) or purchase RECs (also to trade at over $90 per MWh, when the market goes to penalty in a month or so). The wholesale price doesn’t impact on returns to wind power outfits: they hold long-term Power Purchase Agreements, under which they are guaranteed a fixed price, irrespective of the spot or wholesale price. AGL (in its capacity as a retailer) has very large commitments under wind power PPAs in SA (and elsewhere), and pays $112 per MWh whenever its wind power contractors deliver to the grid. It is the high and guaranteed price set by PPAs that allows wind power operators to undercut conventional generators in the spot market – only when the wind is blowing, of course. As to the claim about wind power having zero marginal cost, not so Ben. Infigen, which he quotes below, runs hundreds of clapped out Suzlon s88s at wind farms in SA and NSW and suffers an operations and maintenance cost of $24 per MWh – compared with Ben’s figure of “just $37 and $41 MWh” for the total cost of power delivered to the grid in Victoria. Wind farm operating costs are typically in the range of $25 per MWh dispatched to the grid. That is, every additional MWh delivered, costs an additional $25 to produce; therefore, the marginal cost of production is (at least) $25 per MWh, not zero. And – due to the need for repairs to blades, gearboxes, generators, cooling systems, etc – or wholesale replacement thereof – that cost naturally increases over the life of the turbines used. For more see: Australia’s Most Notorious Wind Power Outfit – Infigen – says “Move Over Pinocchio, Here We Come”]

But expanding the share of wind and solar in a market to more than about 20 per cent of generation can be destabilising. Baseload electricity – coal and gas in Australia – must be available when wind and solar drop out. But as these are forced to the margins, some are being mothballed or closing.

That increases price volatility further, pushing the cost of hedging up. It’s a vicious cycle in a tight market.

“There is a self-propagating effect that means as hedging becomes more difficult, the stability of returns of the few incumbent generators will be impacted, thus leading to more capacity exiting the market,”said the Deloitte report, Energy markets and the implications of renewables: South Australian case study.

[For more on the Deloitte report into how SA’s wind power ‘policy’ has left it with crippling power prices and an unstable grid, prone to mass blackouts: Want Insane Power Prices & Mass Blackouts? Then Wind Power’s your ‘Answer’]

Wind generators say they are unfairly blamed, and volatility is exacerbated by concentration of supply in South Australia and the inter-connector outages. After the closure of more coal and gas power next year there will be only two gas plants operated by AGL Energy and GDF Suez.

Jonathan Upson, government affairs manager at wind-power group Infigen Energy, said this was “exactly the sort of clean energy transformation the International Energy Association states is needed worldwide”.

[No, it’s not. The International Energy Agency (IEA) has said precisely the opposite. From our post – Institute for Energy Research Takes the Scalpel to the Great Wind Power Fraud – the following appears regarding Germany’s wind power disaster:

“As the German government began pursuing aggressive green energy targets by closing reliable power plants, electricity costs dramatically increased. According to the Wall Street Journal: Average electricity prices for companies have jumped 60% over the past five years because of costs passed along as part of government subsidies of renewable energy producers. Prices are now more than double those in the U.S. Due to theses price increases, as many as 800,000 citizens have been unable to pay their electricity bills and have had their power cut off. The situation has gotten so out of hand that the International Energy Agency (IEA) has warned of consumer backlash if the government fails to contain energy costs.”

That doesn’t quite line up with Upson’s piffle – nor does the wind industry’s ‘fortunes’ elsewhere: the ‘transformation’ Upson drools about has to include wind industry ‘pin-up’ Spain, which has crushed wind power ‘investment’ to ZERO: Spain Puts its Economy Destroying Wind Industry to the Sword: ZERO MWs Installed in 2015. But Jonathan’s always had a tortured relationship with the truth and reality (see our post here)]

Mr Upson said wind farms and cheap brown coal power from Victoria helped to keep SA’s electricity prices lower than they would otherwise be, but the loss of the interconnector to Victoria always caused power outages in SA regardless of how many wind farms were operating.

[Upson at his best (see our post here). After the mass wind power blackout on 1 November, wind industry spin doctors, like Upson set out to heap the blame on the interconnectors, when in fact it was all down to a sudden and unpredictable 500MW wind power collapse. Upson’s line on that score is not one that Ben need fall for ever again – see the 1 November wind power output graph above and the commentary below that. Of course, what Infigen has to ‘sell’ has no commercial value, apart from the RECs it attracts. And Ben, next time you’re talking to Upson, ask him if he’s signed a PPA with a commercial retailer in the last 3 years? For background see: Rearranging Deckchairs on the Titanic: or Ian Macfarlane’s Futile Efforts to Save the LRET & his mates at Infigen]

Even so, the problems are real for industry and are not ameliorated by the low spot prices – they can go as low as minus $20 – that occur when wind and solar are generating strongly.

“The forward curve is priced on firm energy – not renewables – and the underlying price of firm energy has really tightened up and is getting worse,” says Peter Dobney, group head of resources and energy for packaging group Orora.

“The damage has already been done. The forward curve has already moved up and it’s not going to come back unless there is a fundamental change in the supply situation”.

Australian Financial Review

Nice work, Ben! Well and truly on the right track; and with a little more research (and ‘research’ doesn’t mean talking to shills like Upson or the Clean Energy Council) you’ll be one of the very few Australian journalists to have worked it out.

The Large-Scale RET is (from hereon) a $45 billion electricity tax, the proceeds of which (in the form of renewable energy certificates) are designed to be directed to outfits like Infigen (aka Babcock and Brown) – that lost $304 million last year, and blamed it on the wind (see our post here).

The $45 billion cost of the RECs issued under the LRET (and/or the penalty charge to retailers who refuse to sign PPAs to get them) will be suffered by all Australian power consumers, consumers just like Port Pirie’s Nyrstar.

For the 750 people employed at Port Pirie’s Nyrstar smelter (and their families), media recognition of the scale and scope of SA’s energy disaster (by the likes of Ben Potter) is a case of too little, too late.

For industry, power prices matter. With mobile capital, operators like Nyrstar have a choice: stay in SA and watch their margins shrink and their profits collapse; or head where they can find power delivered reliably and at sensible prices.

Faced with the highest power prices in the Country, if not the world (on a purchasing power parity basis), yet another of the few remaining large-scale employers in SA is being forced to consider its future.

With the full cost of the REC Tax/Subsidy to power consumers a couple of years away, for SA businesses and families, the worst is yet to come.

As the full cost of the LRET is realised, operations like Nyrstar will be among its many casualties. When it’s inevitably forced to close its gates, there will be a trail of personal misery for hundreds of Nyrstar’s unemployed workers (and their families); and the certain death of one of SA’s major regional centres.

And all because our political betters – from Malcolm Turnbull and Greg Hunt (in Canberra) and Jay Weatherill and Gail Gago (in Adelaide) – are wedded to the delusional nonsense that a wholly weather dependent power generation system can provide an affordable, reliable and secure electricity supply.

South Australians: will the last one out, please turn out the lights?

I’m surprised this other article from AFR about the crisis talks connected with this didn’t get mentioned

http://www.afr.com/news/politics/sa-government-in-energy-market-crisis-talks-with-industry-suppliers-20151214-gln55j

Latest news is that next year might be the end of the Alcoa smelter in Portland, South West Victoria with the loss of 750 jobs.

Is there no end to this madness, pushed by Labor

and the economic illiterate left-leaning Greenies?

“Maybe Weatherill & Co’s heralded “new economy” runs on moonbeams and fairy dust?”

So what better place to “sell” Jay’s visions for South Australia’s new economy than the recent Paris gabfest, where we saw the intrepid new economy entrepreneur complete with film crew striving to interest the gathered multitude of rent seekers and troughers in his wares.

Whether Premier Jay’s glossy, sales pitch attracts investors to South Australia to share in the rich rewards of what he expects will become the world’s foremost unicorn breeding region is yet to be seen.

But I’m sure come next election the population of South Australia will offer due thanks to Jay and his Labor cohorts for visiting widespread energy poverty and unemployment on their once prosperous state.

If we Australians use 22 GW of ‘energy’ we need about 8,800 2MW wind turbines to first, at least operate and second to operate at full capacity and for every minute of every day and night. Just the production of those turbines alone would roughly create a carbon footprint of 2,128,000 tons!

To put that into perspective the Geelong City Council have saved 134 tons of carbon emissions by making a few changes at city hall to the light and heating systems etc.

Changes in demand and supply mean we have a glut of electricity and an oversupply of capacity in the electricity market; and the AEMO says the National Electricity Market needs No new generation capacity. We have heaps so why do we consumers then have to pay the most expensive electricity prices in the world? Yes it’s all the new infrastructure which we don’t need because we don’t need more generation.

Our emissions are relatively stable in Australia, yet should be dropping dramatically as demand for electricity decreases. 34% of Australia’s emissions come from electricity production and as the manufacturing industry across all facets have been dealt a solid blow from rising electricity prices and when it is cheaper to produce goods and relocate overseas and with all the smaller changes like at city hall and in our homes where we just turn off the lights or become disconnected to save power, then that 34% should be lowering…right?

On a vast scale it is mind numbing or dumbing that by 2020 23% of electricity will be produced from renewables. Renewables as they are just like wind turbines create huge carbon footprints and added tax and bill payer expense in their creation.

If the manufacturing of renewables to meet the 23% target is set to be established in Geelong; The few, such precious workers at Keppel Prince in Portland better take note! And exactly what and where are these renewable jobs we hear of in the media? Who does them and how long for? Why create (un) ‘renewables’ jobs to generate electricity we don’t need to create more carbon emissions? Giving me some of that green bubbled bull dust…

Serious stuff! The car industry in SA is on the way out, Arium is in trouble at Whyalla and with the closure of the Leigh Creek coalfields and the Pt Augusta power station and the boys at Moomba tell me with oil under $40 a barrel if a well goes down SANTOS wont fix it, there’s been a lot of good men been shown the door.

Its reassuring to know that those who bought us the $2 billion dollar Ceres wind farm proposal, going to power the expansion of Olympic Dam through hot rocks and boldly go where no man has gone before and frack in Tasmania are going to build a straw biomass plant at Ardrossan.

No investors at this stage or a PPA and not a lot of straw on the books but rest assured the website is on its way!

Thought for the day;

“There’s a fine line between a visionary and a raving lunatic.”

Reblogged this on Climatism and commented:

It is simply astonishing that such an intermittent, unreliable and expensive form of energy is promoted and subsidised so massively to merely “save the planet” – and it cannot, will not and does not even do that!

All hail Gaia! And to hell with industry, houselholds, families, the poor, their jobs, economic growth and prosperity.

We are truly living in a green bubble of eco-insanity.