When the sun sets and/or calm weather sets in, the price gouging by the owners of reliable power generation plant, begins.

When those paragons of corporate virtue that ran Enron started ripping off Californian power consumers during the late 1990s, they did it by shutting down gas pipelines and pretending gas-fired power plants were off-line for “repairs” (see our post here).

But that kind of overt market manipulation was before these same characters worked out that by ‘relying’ on wind and solar, the natural outages delivered on a daily basis would provide more opportunities for skinning power consumers, and leave fewer traces of evidence after the fact, that pesky regulators might use against them.

The model is being employed around the globe, anywhere that you’ll find significant wind or solar capacity attached to the grid.

One such playground for market manipulators, is Western Europe.

Here are a couple of pieces about how a mass collapse in wind power output allowed market manipulators with control over dispatchable generation sources, to have a veritable field day.

European Energy Prices set Records

Watts Up With That?

Andy May

14 September 2021

According to the Wall Street Journal yesterday, due to a rare lack of North Sea wind, already high European energy prices are climbing higher.

“Gas and coal-fired electricity plants were called in to make up the shortfall from wind.

Natural-gas prices, already boosted by the pandemic recovery and a lack of fuel in storage caverns and tanks, hit all-time highs. Thermal coal, long shunned for its carbon emissions, has emerged from a long price slump as utilities are forced to turn on backup power sources.”

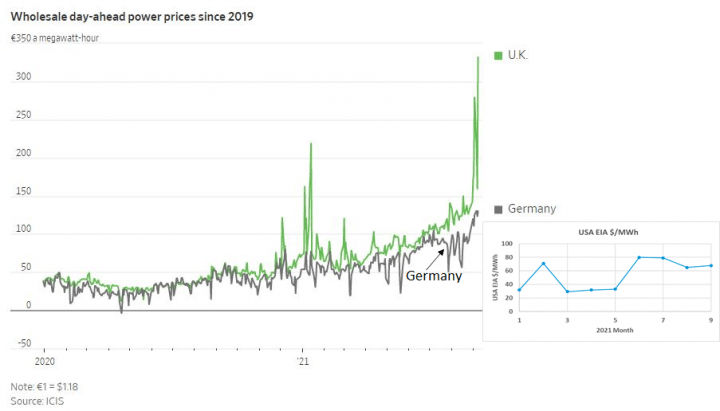

Prices in the U.K have jumped. The inset graph shows average U.S. wholesale electricity prices from the EIA for 2021 in $/MWh but scaled to be roughly equivalent to the EUROs in the larger graph.

“Two U.K. energy retailers—PFP Energy and MoneyPlus Energy—went out of business when electricity prices spiked this month. The companies, with a combined 94,000 gas and power customers, didn’t return requests for comment.

Winners include U.S. and Russian companies exporting gas to Europe, as well as renewable-power suppliers producing electricity with near-zero operating costs. Shares of Cheniere Energy Inc., a major U.S. exporter of liquefied natural gas, have risen 47% this year.”

Ha Ha!

PowerLine

Steven Hayward

13 September 2021

Natural gas and electricity markets were already surging in Europe when a fresh catalyst emerged: The wind in the stormy North Sea stopped blowing.

The sudden slowdown in wind-driven electricity production off the coast of the U.K. in recent weeks whipsawed through regional energy markets. Gas and coal-fired electricity plants were called in to make up the shortfall from wind.

Natural-gas prices, already boosted by the pandemic recovery and a lack of fuel in storage caverns and tanks, hit all-time highs. Thermal coal, long shunned for its carbon emissions, has emerged from a long price slump as utilities are forced to turn on backup power sources.

The wind “stops blowing.” Who would have thought that might happen? Funny how when “green energy” gets into trouble, the backup is always those evil fossil fuels that can be turned up quickly, scale up large, and dispatched where needed on the grid.

Meanwhile, out here in California, to avoid rolling blackouts because of high electricity demands, the state has waived air pollution emission limits so that diesel generators can make up the shortfall.

And yet we’re still on course to close our last nuclear power plant that provides almost 10 percent of the state’s total electricity. PG&E (who are lying corporate socialists) say they can make up the loos wholly from wind and solar power. But I’ll bet they are secretly lining up lots of backup diesel generators.

I wouldn’t criticise the people that are keeping the power working. Remember, gaming the system is the only way they can get enough income to keep paying the bills. The reason this happens is because of the appalling way the power markets are regulated (all countries with unreliables are the same). The market is designed to drive coal and gas companies out of business.

My grandfather had a windmill to pump bore water for cattle. Mind you, he had to have a 90,000 gallon tank to store it when there was no wind.

Relying on breezes and sunshine for electricity is not a good wager.