South Australians suffer the world’s highest power prices because they rely on heavily subsidised and chaotically intermittent wind & solar.

It’s a relationship for which the economic backwater has become world renowned. Along with its notoriety as a (notionally) first world economy with a third world power supply.

If you’re looking to attack the infantile nonsense of running an economy on sunshine and breezes, then routine load shedding and mass blackouts will do it every time.

Remember, this is a state that was once held up as the shining example of the transition to nature’s wonder fuels. And then (for the reasons above), it wasn’t.

Most wind and sun worshippers have gone very quiet about South Australia and, when provoked, avert their gaze and change the subject. However, a few unhinged zealots still want to hold it up as an ‘example’ to the world. But, to do so, they need to rewrite history and invent their own peculiar set of ‘facts’.

The wind and solar industries were built on a mixture of lies and myth, so STT is well accustomed to the manner in which RE zealots take reality and substitute it with their very own.

The latest wheeze – which emanates from the clearly ‘troubled’ Simon Holmes a Court – is that South Australia always suffered from high wholesale power prices, and that wholesale prices have actually fallen thanks to wind and solar, and SA’s ‘rejection’ of coal-fired power.

Simon, who occupies a parallel universe, is also having some difficulty accepting that – with the appointment of Angus Taylor as the Federal Energy Minister – the days of endless subsidies to wind and solar are well and truly over. For some background on Simon see our posts here and here.

Suitably enraged over Taylor’s appointment, Holmes a Court vented spleen in a deluded rant published in The Guardian last week.

It’s so riven with errors and downright lies, we do not propose reproducing it here, or countering Simon’s unhinged and melodramatic piffle.

STT will, however, tackle his version of the history of wholesale power prices in SA.

Simon says:

The truth is that South Australia is an international model of success for energy transition. That such a statement goes so far against the orthodoxy shows the depravity of our national energy conversation.

Electricity prices in South Australia have always been high, but while its wholesale prices are lower than a decade ago in real terms, prices have risen elsewhere.

There are little lies, white lies, little white lies, ‘porkies’ and whoppers.

Where Holmes a Court came unstuck is that the ‘numbers’ that he presents as gospel fact, are all available as a matter of public record. As we detail below, that record demonstrates just how desperate and silly Australia’s RE zealots have become.

The same tangled and tortured pitch is being pushed with maniacal fervour by the boys and girls over at ruin-economy. Ironically, in a piece that waffles on about ‘inconvenient truths‘!

The only problem with Simon’s analysis is that it is complete and utter bunkum.

Here’s what really happened to wholesale prices in SA over the last 20 years.

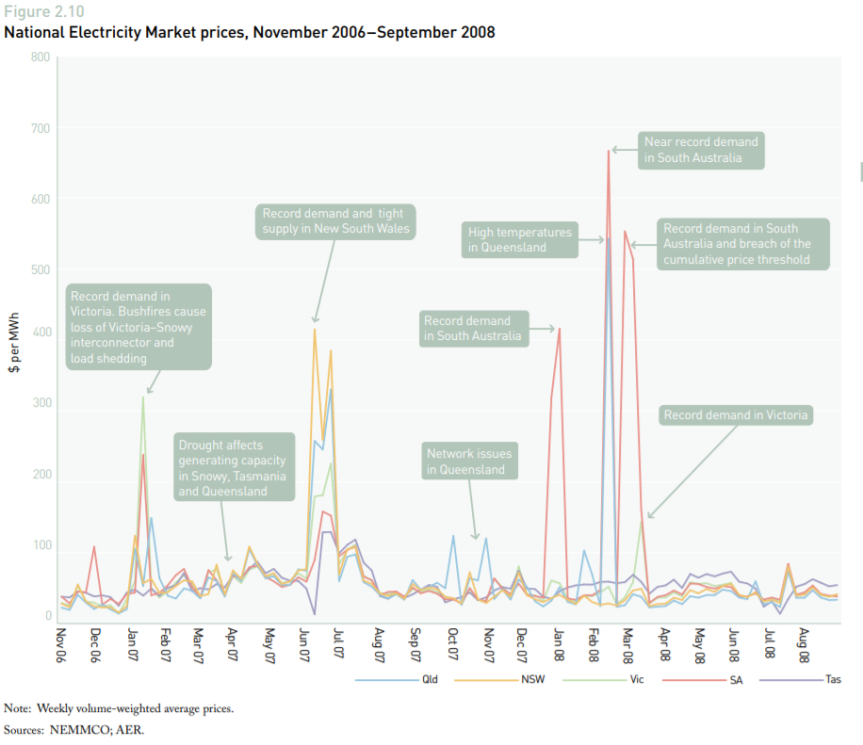

We’ll start with the Australian Energy Regulator’s report from 2008: National Electricity Market 2008. A publicly available document within easy reach of Holmes a Court and his mates at ruin-economy.

Hmmm, now what was it about 2008 that attracted Simon’s attention?

SA’s annual averages appear in the graph above as the redline, with the numbers given in the table below that.

In fairness to Simon, it’s not the first time that overzealous ideologues have jumped on a statistical anomaly and used it to claim a fleeting intellectual ‘victory’. However, it won’t be the last time that that kind of cherry picking comes fantastically unstuck, with the protagonist left red-faced and fuming.

Between 1998 and 2007 the average wholesale price in SA per MWh was between $33 and $69, and on a general downward trend towards 2006. The majority of South Australia’s wind power capacity was built after 2009.

The average wholesale price between 1998-99 and 2006-07 was $50.50, which is $70 less than the $120 figure for 2008 that Holmes a Court plucked out of the ether and included in his tricky little graphic above. Moreover, the average that prevailed until 2008 was fully half the wholesale price that prevails now: Holmes a Court’s graphic has it at $110; the average is closer to $120. But why quibble over a tenner?

What was it that saw SA’s wholesale prices temporarily rocket in 2008? Well, why not go to the AER’s report, once again.

We’re going out on a limb here, but ‘near record demand’ in SA during 2008 seems to be of some interest to the AER. Let’s go to the body of the AER’s report for some fairly important details, this from pages 87-88:

2.5.1 Wholesale market update: 2007-2008

The drought continued to affect wholesale electricity prices in New South Wales, Victoria, Queensland and Tasmania during the September quarter of 2007. South Australia was less affected as its generators do not depend on fresh water for cooling. By the end of the quarter, drought conditions in New South Wales and Queensland had eased and prices across the NEM had fallen back towards pre-drought levels.

Wholesale prices in the December quarter were relatively subdued across most of the NEM. Queensland experienced some high-price events due to planned and unplanned network outages and aggressive bidding by a number of generators.

The March quarter of 2008 was characterised by high electricity prices in South Australia, Queensland and Victoria. South Australia experienced record high prices, averaging $243 per MWh over the quarter compared to the previous NEM record of $146 per MWh.

A number of factors contributed to South Australia’s record high prices:

> Adelaide experienced high temperatures in January and February and an unprecedented 15-day heat wave in March 2008. The extreme temperatures led to record demand.

> A significant proportion of South Australia’s electricity is sourced from Victorian generators via the Heywood and Murraylink interconnectors. In December 2007, the South Australian transmission network owner, ElectraNet, reduced the maximum allowable flows on the Heywood interconnector by about 25 per cent.

This constrained the supply of low-cost generation from Victoria.

> AGL Energy, which owns about 39 per cent of South Australia’s generation capacity, bid a significant proportion of its capacity at close to the price cap during the periods of high demand.

In combination, these factors led to extreme prices in South Australia in March 2008. The National Electricity Rules provide a mechanism that triggers an administered price cap during times of sustained high prices. When the sum of the prices over the previous week exceeds $150000 (the cumulative price threshold), administered pricing automatically caps the price at $300 per MWh until the end of that trading day.

On the last day of the South Australian heatwave, prices reached the cumulative price threshold and administered price caps were applied. This was the first time that administered pricing had been triggered since the commencement of the NEM in 1998.

The AER is investigating the high price events in South Australia and, in particular, whether generator bidding behaviour breached the National Electricity Law and Rules. The AER is also investigating the flow limits placed on the Heywood interconnector by ElectraNet.

In the June quarter of 2008, prices across the NEM were relatively subdued, with no extreme price events.

This is consistent with the normal historical tendency for peak demand and prices to be relatively stable during autumn. The unusually high prices in autumn 2007 mainly reflected drought conditions. More benign weather conditions in 2008 led to a return to lower prices.

The market in the third quarter of 2008 remained relatively quiet, apart from a price spike across the mainland NEM regions on 23 July due to an unplanned outage of two transmission lines in Victoria. The AER is investigating this incident.

Another line from Simon Holmes a Court’s Wonder World is not only that SA’s wholesale power prices have always been historically high, they’ve been higher than the other Australian states and, therefore, presumably higher than comparable countries, around the world. The AER data suggests otherwise – this from the same report:

The numbers above don’t suggest that SA suffered any kind of wholesale power price punishment relative to its local or international peers. At least up to 2007. As noted above, SA didn’t start building wind capacity in earnest until 2009.

The reason that Holmes a Court and his gang were seeking to reinvent history, was to make the risible claim that wholesale power prices have fallen since 2008, thanks to the wonders of wind and solar.

We’ll pick up the thread from the most recent AER National Energy Market report published in 2017 but updated in August this year: State of the energy market 2017

And this from pages 51-55 of the AER report:

Prices continued their upward trajectory on the mainland in the nine months to 31 March 2017, with the steepest rises occurring in South Australia, Queensland and NSW. Against this pattern, Victorian prices held relatively steady over this period, and Tasmanian prices eased off their historical peak of the previous year.

More generally, the market has been extremely volatile since winter 2015, particularly in Queensland, South Australia and Tasmania. Thirty minute prices exceeded $200 per MWh almost 4000 times in 2015–16, which was an unprecedented number. And another 2100 instances were recorded in the first nine months of 2016–17.

The causes of this volatility are complex and differ between regions, although common factors are evident. One common thread is a tightening in the supply–demand balance. In particular, the closure or mothballing of significant coal fired plant has coincided with a resurgence in peak demand, particularly in NSW and Queensland.

These conditions affected the entire market in June 2016, when the closure of Alinta’s Northern power station in South Australia, combined with maintenance on other coal plant, caused a 2200 MW reduction in available capacity compared with a year earlier. This reduction in supply meant gas fired generation was setting the dispatch price more often than usual—at a time when gas fuel costs were extremely high.

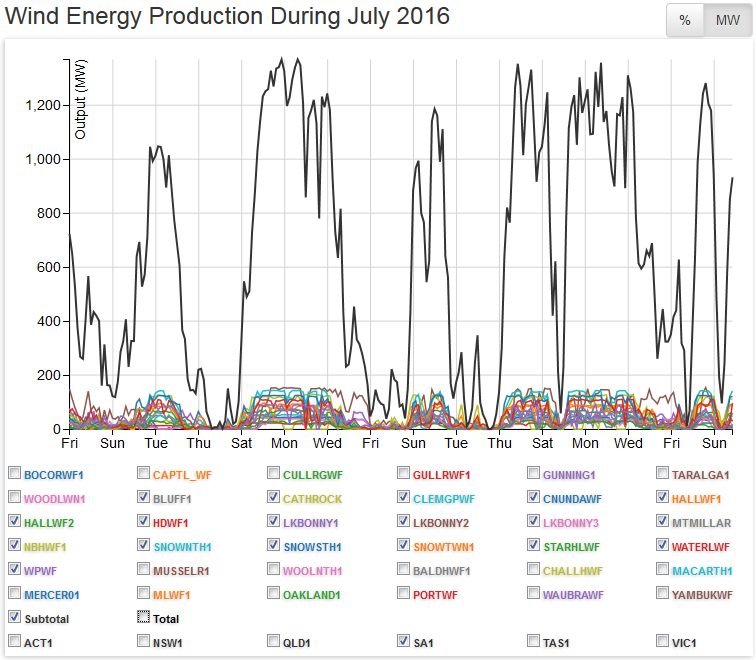

The market stabilised in most regions in July 2016, but prices remained high in South Australia. In that state, work to upgrade the Heywood interconnector constrained the state’s import capacity in a period of low wind generation.

South Australian market

Wholesale electricity prices tend to be higher and more volatile in South Australia than elsewhere. This price differentiation partly reflects South Australia’s historical reliance on gas powered generation, and its higher ratio of peak to average demand (compared with other NEM regions). Other contributing factors are the region’s relatively concentrated generator ownership, generator bidding behaviour, thermal plant withdrawals, and limited import capability. South Australia’s high levels of wind capacity also contribute to price swings, given wind’s intermittent nature.

When the AER talks about “wind’s intermittent nature” – as if it were one of Donald Rumsfeld’s “unknown unknowns” (ie the kind of stuff we couldn’t see coming) – this is what they mean:

And the source of all that ‘volatility’ in SA’s power market just might be???

The AER went on to say:

South Australia’s supply–demand balance has progressively tightened since the part mothballing of Engie’s Pelican Point plant (249 MW) in April 2015, and Alinta’s closure of its Northern power station in May 2016 (546 MW). …

Since the closure of the Northern plant, South Australia’s generation stock consists primarily of gas and wind plant. But wind generation was low in July 2016 [see above], averaging 57 per cent below the historical monthly average. To fill the gap, more gas powered plant than usual was dispatched, and at a time when LNG export demand had driven gas fuel prices to unprecedented levels.

As a result, South Australian prices diverged materially from other regions for around 60 per cent of the time in July 2016, with gas plant typically setting the spot price at these times. Many prices settled above $500 per MWh, and three prices exceeded $5000 per MWh.

South Australia continued to experience several bouts of market volatility and extreme prices in 2016–17. In the nine months to 31 March 2017, its weekly prices averaged $128 per MWh, which was an unprecedented level for the NEM (table 1.7). South Australia also experienced security issues over the period, including load shedding and blackouts.

As we noted above, the average wholesale price between 1998-99 and 2006-07 was $50.50.

If we treat 2007-08 as a statistical outlier (which it clearly is for the reasons identified by the AER above) and take the annual averages in SA from 2008-09 through to 2016-17, the average wholesale price in SA over that period is $67.22.

But, if the starting point is after May 2016 – when Alinta closed its coal-fired Northern power station and SA lost 546 MW of reliable, baseload power – up to 2016-17 the average is $97.50, close to double the rates that prevailed between 1998-99 and 2006-07, but still less than the current figure of $110 quoted by Holmes a Court in his epistle to The Guardian.

Of course, South Australians really couldn’t care less about wholesale power prices, because they pay retail prices for power. Oh, did we happen to mention that South Australians pay the world’s highest retail power prices?

Australian retail power prices include the cost of Renewable Energy Certificates, currently worth $85 each. The REC is the mandated subsidy to renewable energy in Australia, and one is issued to wind and solar outfits for every MWh of wind and large-scale solar dispatched to the grid.

With 50% of its electricity coming from wind and solar, every other MWh of electricity generated in SA attracts a REC, the cost of which is collected through retail power bills.

South Australians not only suffer the highest wholesale prices in Australia, every second MWh of power consumed in SA costs retail customers an extra $85 per MWh, thanks to the RECs issued under the Federal government’s Large-Scale RET.

Whether your metric is power prices or reliability, SA is hardly the “international model of success for energy transition” suggested by Simon Holmes a Court. Unless, of course, suffering the world’s highest power prices, load shedding and blackouts is all part of what Holmes a Court deems a ‘successful’ “energy transition”?

Nuclear SMR’s

Keep the crackpots quiet on both sides

The similarities of Simon HaC’s parallel universe with the character Zaphod Beeblebrox are striking STT. Wiki describes Zaphod as “hedonistic and irresponsible, narcissistic almost to the point of solipsism, and often extremely insensitive to the feelings of those around him”. Life imitating Art perhaps ?

For some people to utter such bald faced inaccuracies suggests there is a problem with facing the truth.

Not surprising considering so many of the RE zealots are now facing a situation where they have to face up to and admit they have been fooled and were unlikely to be able to recognise: they are not capable of recognising a confidence trick, they were blinded by the thought they were the only ones who could see ‘the light’, they had an axe to grind (financial or otherwise) or they were taken for suckers.

Not things people with inflated ego’s would want to do so they keep on keeping on.

What was that campaign slogan used by Vesta and the RE Zealots – ‘Act on Facts’ wasn’t it – well lets see them follow through – honestly!

Some things they campaign on apart from reduced prices:

Turbine noise causes no health issues

Turbine noise causes no harm to creatures large and small or the environment

There is no need for back up energy supplies to keep ‘the lights on’.

Everyone supports their arrival in their local community

Truth seems to have been lost in the spiel.

I have listened gobsmacked to this so called University expert. If this is the level of the people teaching at our universities who are just a bunch of ideologes and pay no attention to real facts the future for Australia is very dim indeed.