Plenty of what Westerners know about the Middle Kingdom is more marvellous myth than solid fact. Fitting squarely within that category is the idea pedalled by wind worshippers that China is working at a furious pace to carpet itself with millions of these things.

In truth, instead of squandering billions on a technology that was abandoned around the time the rot set in for the Qing Dynasty in the 19th century, China has built a phenomenal capacity in hydro power; and is building nuclear and high-efficiency coal-fired plant in order to bring affordable and reliable power to the masses: at present, China is building a coal-fired plant every other day, with plans to export their electricity to power starved Germans.

Just like everywhere else, the wind industry in China overstated its case; claiming that its costs were far lower than those actually realised; and, conversely, claiming that capacity factors (ie the average amount of time a wind turbine can be expected to actually produce electricity) were much higher than the reality.

Now the numbers have caught up with China’s wind industry.

In this recent paper, a group of Chinese energy market economists have reached the conclusion that the costs of pursuing a wind powered future are magnitudes greater than what had been predicted; and that the cost of obtaining the purported environmental benefits of wind power – CO2 emissions reduction – are almost 6 times what was originally claimed.

In this post we set out the abstract to the paper, as well as its discussion and conclusions. We also provide a link to the whole paper for those keen to know more on what’s really happening in China’s energy advance.

China’s wind electricity and cost of carbon mitigation are more expensive than anticipated

Environmental Research Letters 11(8)

Long T Lam, Lee Bransetter & Inês M L Azevedo

18 August 2016

Abstract

The success of China’s transition to a low-carbon energy system will be key to achieve the global level of emissions reductions needed to avoid large negative consequences from climate change. China is undergoing an impressive build up of renewable capacity, in particular wind. Using data from the Clean Mechanism Development project database between 2004 and 2012, this study shows that while China made progress in bringing down the levelized cost of wind electricity and cost of carbon mitigation (CCM), serious grid-connection issues and high wind curtailment rates resulted in a levelized cost of wind electricity that is one-half to two times higher than expected, and a CCM that is four to six times higher. Sharp drop in electricity demand, utilization rate, and coal prices in recent years may lead to even higher results.

4. Discussion and conclusions

In this paper we illustrate the scale of connection and curtailment problems of China’s wind energy industry across provinces, their affect on China’s wind capacity factor, LCOE produced by wind, and the associated CCM. We show that China’s wind capacity factor is much lower than developers anticipated in their ex-ante estimates. As a result, the corresponding wind LCOE and CCM in reality are also higher than expected.

This work has some caveats and limitations. First, CDM data on capital investment costs do not necessarily reflect the real costs of wind turbines in the Chinese markets. It could be the case that SOEs, which make up more than 90% of the market in recent years, intentionally distorted product prices to gain market share. The LCOE and CCM estimates are then higher in this case.

We explore this possibility by varying the investment costs and the O&M costs in more detail in the SI (table S6).

The LCOE is more sensitive to the capital investments and the capacity factors. For instance, in the scenario where the capital investment is 30% higher, the lowest LCOE is 0.51 yuan kWh−1, which occurred in 2012 using CDM ex-ante capacity factor, 0.12 yuan kWh−1 or 24% higher than the corresponding baseline case. Using the ex-post capacity results in a 0.63 yuan kWh−1 LCOE for the same year, 0.24 yuan kWh−1 or 24% higher than the corresponding baseline case.

Estimates for the first half of our sample period may be more accurate, when foreign and private firms still had a substantial market share, and the industry was not as competitive.

Additionally, Chinese wind farms bear a number of tax burdens, and of these, income tax, value-added tax (VAT), urban maintenance and construction tax, and education surcharges are not reflected in the total investment costs.

Chinese wind farms enjoy full income tax exemption in the first three years, half exemption in the following three years, and a preferential 15% income tax rate thereafter (Liu et al 2015). However, given the large discrepancy between the expected generation and the actual generation of wind electricity across the country as well as the widely reported delays in payments to the generators, many generators during this the sample period operated at very tight margins, and would not have to pay significant income taxes.

Based on the FITs for wind, we estimate that the VAT, urban maintenance and construction tax, and education surcharges total to approximately 0.047–0.056 yuan kWh−1 (nominal).

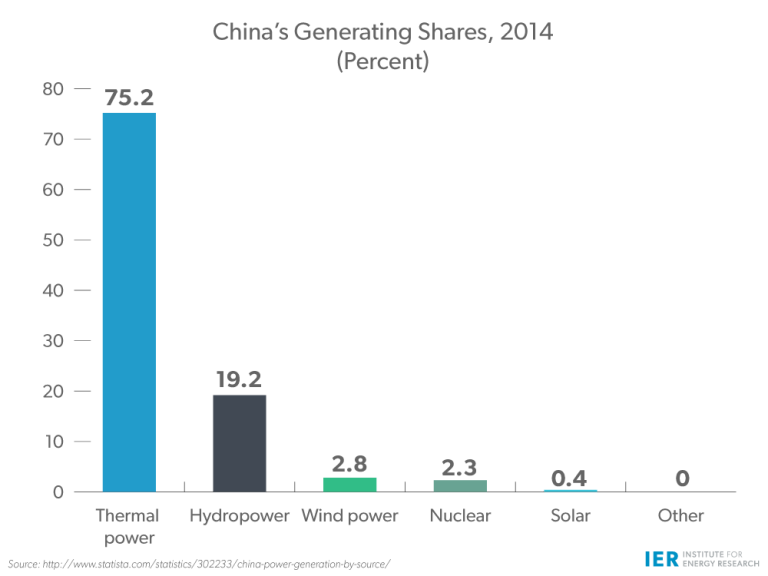

Second, in calculating the CCM, we assume that wind power plants replace coal-fired power plants. While smaller in its contribution to electricity generation, hydropower was still responsible for 14%–17% of China’s electricity in our sample period (CEC China Electricity Council 2015), thus the actual baseline LCOE would have to account for hydropower’s LCOE as well.

Third, we consider scenarios where China’s coal fleet is made up exclusively of subcritical or supercritical plants. Thus the results reported here are likely the lower and upper bounds.

Finally, we do not consider how integrating electricity produced by wind could affect the CO2 emissions and the associated CCM of the rest of system. When a traditional (mostly coal-fired in China) generator ramps up and down to compensate for wind’s intermittency and variability, it may require more fuel use than when it is operated at a steady level, thus wind integration may increase CO2 emissions and CCM (Katzenstein and Apt 2008, Zhang et al 2015).

The success of China’s transition to a low-carbon energy system will be key to achieve the global level of emissions reductions needed to avoid large negative consequences from climate change.

On the surface, the rapid build-out in the past decade appears to represent a triumph of China’s centralized government-directed approach to investment. However, China has struggled to utilize this massive installed base effectively.

In 2015 alone wind curtailment exceeds 33.9 TWh. Had all of these spilled electrons been used, and assuming that would be able to avoid the generation from the average electricity mix, about 29.5 million on of CO2 would have been avoided—roughly the same amount of CO2 Connecticut produces (EIA Energy Information Administration 2015a, 2015b).

Between 2011 and 2015 China’s grid systems curtailed approximately 96.5 TWh of wind electricity, missing the opportunity to avoid 84 million tons of CO2. Moreover, because the actual amount of electricity consumption determines how much revenue and the number of CDM emission reduction credits wind farm owners can earn, wind farm owners have lost billions of RMB due to these large production shortfalls.

The still-large gap between installed capacity and renewable energy usage helps explain one of the painful realities of China’s green energy push: after a decade of unprecedented expansion, renewables have risen from 6% to only 9% of China’s total primary energy consumption, and 7% of this total is generated by hydropower (BP 2015).

Macroeconomic trends also present daunting challenges as China pushes forward with its ambitious renewable energy development plans (please see the SI for more information). China’s economy has slowed substantially in recent years, and the electricity consumption growth rate has suddenly come to a virtual halt.

In 2015 China’s economy grew 6.9%, but the electricity consumption rate increased merely half a percentage point (see figure S2 in the SI). Nevertheless, the country’s energy supply has continued to expand at a rapid pace. Last year, thermal capacity (mostly coal) grew by 8% (see figure S4 in the SI), hydropower 6%, and wind 36%. The slowdown in energy demand coupled with a business-as-usual increase in supply have led to sharp reductions in utilization rates across all energy sources (see figure S3 in the SI).

Nevertheless, China has decided to redouble its efforts and press on with its renewable energy development plans. The country now wants to lift its wind power target to 250 GW, or twice the current capacity, by 2020. By the same year, it aims to install 150 to 200 GW of solar power (Reed 2015), and 58 GW of nuclear power (WNA World Nuclear Association 2016).

At the COP21 meeting, China committed to a 20% non-fossil primary energy consumption target by 2030, an ambitious target. In order to achieve these goals and successfully integrate renewable energy into the country’s existing power generation system, serious reform efforts are needed.

Interprovincial power exchange markets and improvements in transmission infrastructure are likely key to the successful growth of low carbon electricity in China.

Between 2011 and 2014, Inner Mongolia’s electric power generation capacity grew by 18.69 GW, of which 4.76 GW came from wind power. (Thermal power accounted for most of the remainder.)

Assuming a 60% capacity factor, the new thermal capacity alone could provide Inner Mongolia with 73.2 TWh of energy, some 18 TWh more than the increase in consumption during this period.

Put differently, Inner Mongolia could satisfy its energy needs without renewables.

Exporting its excess electricity production using non-UHV lines to the energy-thirsty coastal region to alleviate some of Inner Mongolia’s curtailment problems remains difficult without a robust electricity network and a mature market exchange. Similar problems exist in other provinces with high wind curtailment rates such as Gansu and Jilin. As per the NEA’s mandate, wind turbine construction in these provinces had been halted until curtailment problems are adequately addressed (NEA National Energy Administration 2016a).

Some have called for a more flexible power generation system that would consist of pumped hydro storage and electric boilers (Lu et al 2016). Indeed, Zhang et al (2015) demonstrate that the deployment of pumped hydro storage and electric boilers can be a cost-effective method to reduce curtailments of wind power in a power system that heavily relies combined-heat-and-power plants.

The NEA is pushing Northern provinces to use wind energy that would otherwise go to waste for residential heating instead, and a pilot project is expected to complete in Inner Mongolia in 2020 (Liu 2015). However, significant challenges remain as the government manages competing interests among the stakeholders, and there are questions regarding the economics of a provincial or national deployment program.

Traditionally, China follows an ‘equal shares’ system, where coal-powered generating plants are given contracts with fixed electricity prices, and the operating hours are allocated equally across the generators. This policy effectively shuts out renewable energy by carving out and reserving a significant chunk of the electricity market for expensive and inefficient coal plants.

In principle, a priority dispatch system where priority is given to renewable energy in the dispatch sequence can increase the demand for electricity produced by renewable sources. The amendments to the renewable energy law require grid operators in five provinces to move past the generation guarantee quota system and establish a priority dispatch sequence, though grid operators are still allowed to curtail wind electricity output under certain system constraints.

Recently China announced its intention to commit to a national green dispatch program (The White House, Office of the Press Secretary 2015), though neither the program’s timeline nor its implementation is clear. China is also considering a power generation quota system where provinces must generate a certain fraction of their electricity from renewable sources, though enforcement methods are again unclear (NEA National Energy Administration 2016b).

Long T Lam, Lee Bransetter & Inês M L Azevedo

The full paper is available here: http://iopscience.iop.org/article/10.1088/1748-9326/11/8/084015

China needs to boost Nuclear?

It is.

Hi,

I started a PETITION “SA PREMIER JAY WEATHERILL : Demand the RESIGNATION of the Energy Minister for HIGH POWER PRICES CAUSING SA’s JOBS CRISIS and 15,000 household POWER DISCONNECTIONS, frequent POWER BLACKOUTS and the JULY 2016 POWER CRISIS” and wanted to see if you could help by adding your name.

Our goal is to reach 100 signatures and we need more support.

You can read more and sign the petition here:

https://www.change.org/p/sa-premier-jay-weatherill-demand-the-resignation-of-the-energy-minister-for-high-power-prices-causing-sa-s-jobs-crisis-and-also-15-000-household-power-disconnections-frequent-power-blackouts-and-the-july-2016-power-crisis?recruiter=135406845&utm_source=share_petition&utm_medium=email&utm_campaign=share_email_responsive

Please share this petition with anyone you think may be interested in signing it.

Thankyou for your time.

Reblogged this on Jaffer's blog.

Does STT agree that rising CO2 is not a problem and that rather than being harmful is beneficial?

Brian, CO2 is a naturally occurring beneficial trace gas, essential for life on Earth. However, for the purpose of avoiding getting bogged down in (what for us is) a sideshow, we assume it is a ‘problem’ but dedicate our efforts to explaining why wind power is NO solution to that ‘problem’ or anything else for that matter. You’ll find a detailed explanation of our views here:

I love shoving information like this in the face of closed minds.

Reblogged this on Climatism and commented:

China setup their own small-scale wind and solar power generation purely to appease the West in a symbolic show of “Green” faith.

Where they are winning, big-time, is in the mass-manufacture of wind and solar applications, sold back to the climate change obsessed West.

And the power used to manufacture the 16th Century industrial windmills, ironically, coming from the very coal that the West has condemned, demonised and shipped-off to China so she can open a coal-fired power station every week!

Insanity on a bizarre level.

Great post STT….