****

STT has been pointing out for sometime now, the fact that Australia’s big 3 power retailers have been refusing to ‘play ball’ with beleaguered wind power cowboys, like near-bankrupt, Infigen and the union super fund backed disaster, Pacific Hydro.

Commercial retailers have not entered any power purchase agreements with wind power outfits, since about November 2012; and have made it very clear that they have no intention of doing so, any time soon.

As we noted back in September last year – Let the Sun Shine In: Australia’s BIGGEST Power Retailer Determined to Kill Wind Power – Australia’s big retailers had created a strategy that would kill 2 birds with one well-aimed stone. The first victim on their radar being the wind industry in Australia; and the second glittering prize, the completely unsustainable Large-Scale Renewable Energy Target.

Here’s how the strategy is unfolding, courtesy of the AFR.

Investment in renewables lags

Australian Financial Review

Angela Macdonald-Smith

15 January 2016

Investment in large renewable energy projects in Australia is running at just one-third of what is needed to meet the 2020 Renewable Energy Target and behind countries such as Thailand and Morocco, Bloomberg New Energy Finance has found.

Spending on large projects recovered slightly last year from the depths of the 2014 investment freeze, but the $1.18 billion compares with a peak of $3.29 billion in 2010 and with the $3.6 billion a year that is needed to meet the target, analysts said in a report on Thursday.

BNEF blamed the shortfall on a lingering lack of confidence in the RET policy last year as it was undermined by the Abbott government’s review of the scheme.

Since the review was announced on February 17, 2014, only $15 million of investment has been driven by the RET policy, compared with more than $12 billion in the period prior to that and since the scheme was born in 2001, Sydney-based analysts Kobad Bhavnagri and Stephanie Allport found.

The weak numbers are in contrast to the keen response to a $100 million funding program for large-scale solar prices from the Australian Renewable Energy Agency, where 77 expressions of interest have been whittled down to 22 projects. Those project proponents are seeking more than three times as much funding as is on offer for projects that would cost $1.68 billion to build.

Total investment in new, clean energy in Australia was $US2.97 billion ($4.3 billion) last year, a modest increase on 2014 but well down on the $US6.74 billion spent in the peak year of 2011, BNEF said in its global report.

Investment in small-scale solar PV installations helped support the sector, while investment in large-scale assets “continues to stall,” BNEF said. The ACT’s reverse auction program for renewable projects, grant funding from ARENA and lending from the Clean Energy Finance Corporation propped up investment, it said.

Australia’s total investment in the sector put it 12th behind resource-intensive economies including Chile, Canada, South Africa and Brazil.

Australia’s performance contrasted with the global picture, with worldwide investment in clean energy reaching a record $US329.3 billion last year, up 4 per cent on 2014. China was again the biggest investor, with a 17 per cent increase to $US110.5 billion.

Australian Financial Review

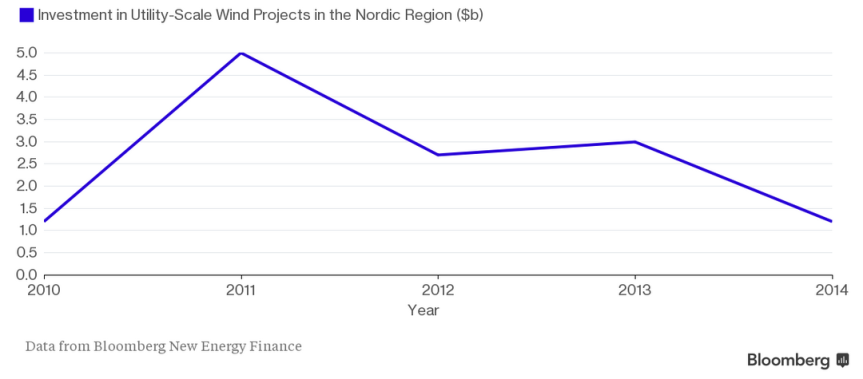

Angela Macdonald-Smith putting a brave but desperate face on for her buddies in the wind industry; clutching to any sign, anywhere, of a willingness to invest in the greatest Ponzi scheme devised. But, sorry Angela, the global numbers tell the story (see above): the wind industry is in free-fall, everywhere, including the wind industry’s former Scandinavian ‘sweethearts’, Sweden, Denmark, Finland & Norway.

And Angela’s obviously also keen to keep up the Fairfax line about these things being ‘clean’.

Apparently, Angela hasn’t tried to dump worn out and broken blades full of Bisphenol A, a highly toxic substance, banned in most western countries on health grounds. Which means they can’t be recycled and are dumped, instead, as mountains of toxic waste.

And she clearly hasn’t visited China’s toxic lakes surrounding its rare earth plants producing the millions of tonnes of neodymium and dysprosium essential for the magnets of turbine generators.

Here’s Angela again, unknowingly detailing the death-knell for wind power in Australia.

Origin, Infigen, APA vie for $100m of solar project funds

Australian Financial Review

Angela Macdonald-Smith

14 January 2016

Origin Energy, Infigen Energy and APA Group are among a host of players vying for a share of $100 million of government funding to build large-scale solar projects as the industry chases costs down to match or potentially beat wind power.

The Australian Renewable Energy Agency has selected 22 individual projects to go through to the final bid stage, seeking in total more than three times as much funding than is on offer.

The projects, which are to be formally announced by ARENA and federal Environment Minister Greg Hunt on Thursday and include several potential new foreign entrants into Australia, have been selected from 77 expressions of interest.

They include a mega project of more than 100 megawatts by Origin in Queensland, and smaller ventures planned by foreign players including China’s Goldwind, Germany’s juwi and Spain’s FRV. Potentially only between four and 10 projects are set to win funds, with ARENA providing grants of up to $30 million apiece. The Clean Energy Finance Corporation is offering debt funding through a complementary $250 million financing program.

ARENA chief executive Ivor Frischknecht said the keen interest in the funding round showed “Australia is serious about deploying large-scale solar and capitalising on its abundant solar resources”.

The 22 projects representing 766 megawatts of capacity, are asking for about $332 million of funds for plants that would require investment of $1.68 billion to build. They are all on mainland Australia, with 10 in Queensland, eight in NSW, two in Victoria and one each in WA and SA.

The program is intended to drive the development of about 200 megawatts of large-scale solar, which would almost double capacity to 440 megawatts, enough to power 120,000 homes, Mr Hunt’s office said.

AGL Energy, the owner of the country’s two largest utility-scale photovoltaic plants, at Nyngan and Broken Hill in NSW, which received government funding in 2013, is not on the short list.

The program aims to lower the cost of large-scale solar energy so it is competitive with wind power by the end of the decade. It requires solar projects to deliver electricity at $135 a megawatt-hour in this funding round, on the way to meeting the typical cost of wind power of $80-$90 a megawatt/hour.

Mr Frischknecht said some of the competing projects were anticipating costs “significantly below” $135 a megawatt/hour. The funding round would help drive innovation and reduce solar PV supply chain costs in Australia, where large-scale solar is still in its infancy compared with rooftop solar and some overseas countries.

Origin Energy is looking to get in to large-scale solar despite seeking to sell its wind power business in Australia and its international renewable energy portfolio. Chief executive Grant King has voiced confidence about the potential for large-scale solar to undercut wind power. Its Darling Downs project is planned for a site adjacent to a gas-fired power plant, and is near council approval.

Mr Frischknecht said that the local industry had the potential to bring down costs to less than $100 a megawatt/hour by 2020.

The CEFC’s financing program also supports other solar projects that require loans of $15 million or more and is intended to unlock additional private-sector investment in the sector.

Australian Financial Review

STT has to hand it to Greg Hunt’s office (was it you Patrick?) when his spruiker comes out with the line that 440 megawatts of solar is “enough to power 120,000 homes”.

Would these panels powering 120,000 homes around the clock be situated in outer space, where the Sunshine never ends, perhaps?

Or are these householders going to be satisfied with a lifestyle that revolves around power being available 8-10 hours a day: starting an hour or more after sun-up and ending an hour or more before sun-down – providing it’s not raining or overcast. Nice one Patrick! You nearly had us for fools.

What the AFR is yet to pick up on, and Greg Hunt and his cohorts don’t care to admit, is that the switch to large-scale solar is a temporary move aimed at avoiding the penalties set by the LRET, until such time as the politics become totally toxic; and who ever is in power is forced to scrap the most ridiculously costly and pointless policy in the history of the Commonwealth.

Willing to be accused of stating the bleeding obvious, electricity retailers aren’t in the business of NOT selling power; they’re in the business of selling power, at a profitable margin, to as many customers as possible.

The ONLY reason that they display an ‘interest’ in renewable power at all, is the need to obtain renewable energy certificates, in order to avoid a whopping $65 per MWh Federally mandated fine for every MWh the retailer falls short of the mandatory LRET target (the fine dwarfs the average wholesale price of $35 per MWh).

The rush to carpet northern NSW and southern Queensland in solar panels is all about obtaining RECs to avoid fines that will add up to more than $21 billion over the life of the LRET:

What Kills the Australian Wind Industry: A $45 Billion Federal Power Tax

The cost of the fines and purchasing RECs – which themselves will add a further $23 billion to Australian power bills – will all be passed on to power consumers, tens of thousands of whom can’t afford power, right now:

Victoria’s Wind Rush sees 34,000 Households Chopped from the Power Grid

Casualties of South Australia’s Wind Power Debacle Mount: Thousands Can’t Afford Power

In Australia’s economically dismal wind power capital, South Australia, already thousands of manufacturing and mineral processing jobs hang in the balance – due to an unstable grid and skyrocketing power prices:

With more than $45 billion in REC Tax and fines to be collected from here, as the LRET starts to bite in the next two or three years, power prices are set to double: an outcome that is pure political poison; and will ultimately result in the LRET being scrapped. Any policy which is both economically and politically unsustainable will fail.

And that is one of the very strong factors, that’s turning the big retailers into ‘Sun-worshippers’. However, STT hears that the planned rollout of panels is designed as a temporary measure. When the LRET is inevitably scrapped in a few years time, the retailers plan to pack up the panels; and sell them to households, to be stuck on homes all over suburban Australia.

****

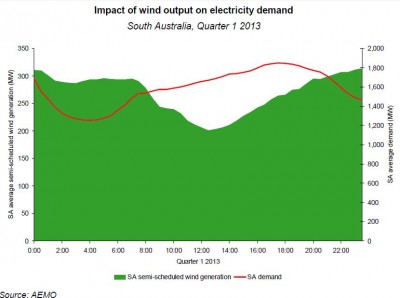

Another reason that retailers are talking about solar, is the fickle nature of the wind itself.

The Sun, you can set your watch by. From sun-up, and especially by high noon – and for 5 or 6 hours thereafter – a sea of solar panels in the sunnier parts of Australia are able to send power into the grid, at a point of the day when it’s actually needed.

Wind power, on the other hand, usually saves its whimsical ‘best’ until the wee hours of the morning, when there’s very little demand for power at all. And, most of the time, produces little more than pure chaos:

The reason that Origin has headed for Queensland is not so much that its panels will be bathed in tropical sunshine, but that the day-time spot price in the Sunshine State is the highest among the eastern states – averaging around $60-70 per MWh. That, and a REC that will trade at around $90 (1 for every MWh delivered) until the LRET collapses, makes the move to solar a canny one. The REC Subsidy will have well and truly paid for the panels by the time the LRET goes; and, thereafter, Origin will have thousands of panels to sell to domestic users, effectively double-dipping on the deal.

But the reason that Origin (and Australia’s other big retailers) has turned its back to the wind, is that Grant King is acutely aware that litigation against wind farm developers launched by furious neighbours is a matter of when, not if. Hence Origin’s move to ditch its wind farm at Cullerin, NSW; as well as its proposed Stockyard Hill disaster in Victoria.

STT hears that Grant King knows all about the effects of incessant turbine generated low-frequency noise and infrasound on wind farm neighbours; and bemoans their foray into wind power, complaining that no other part of their business attracts anything like the number of complaints.

The big retailers were all paying close attention to the Australian Senate’s wind farm inquiry and the delivery of its thumping report, as well as the evidence of rural communities given to the inquiry by those currently suffering from turbine noise effects, including that given by turbine hosts, Clive and Trina Gare.

The Gares – despite earning $200,000 a year hosting 19 of these things – told the Inquiry that it was the worst decision of their lives; and that, if they knew then, what they know now, they would not live within 20 km of a wind farm:

Australia’s power retailers may be greedy, but, in the light of that kind of irrefutable evidence, they’re not stupid.

Signing up with a wind power outfit that will wind up in insolvency – when it gets sued by its neighbours in nuisance for millions in damages for loss of the use and enjoyment of their homes – and the resulting loss in the value of their properties – doesn’t make a whole lot of business sense:

Where outrage and community division follow the wind industry wherever it goes, there’s been no such hostility generated by solar panels.

With all that in mind, it’s no surprise that Australia’s big retailers have turned towards the Sun.

I so love that people like Mick Head (I have a different name for him) Trustpower’s project manager would be starting to worry about job security. .. also, when this parasite of an industry falls over, we must help the ones left dealing with turbines by getting huge compensation. .. Party at my house when it happens…

Good on you, Shane. Can’t wait for the “After-Party.”