The world’s wind turbine makers are bleeding cash; none of them are capable of turning a profit and all of them are facing financial ruin.

General Electric’s renewables business blew a cool $2.2bn of shareholder value in 2022.

Siemens Gamesa has axed hundreds of jobs in Europe and America. Vestas, Nordex and Enercon are also facing financial ruin, and for all the same reasons.

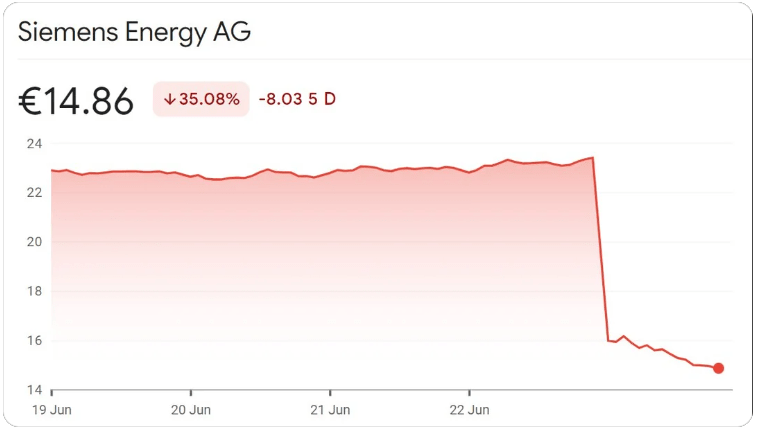

In this piece, Gordon Hughes focuses on Siemens Energy, which thanks to a perfect storm of collapsing subsidies and a thoroughly defective product has seen its share price slaughtered, with further details of the carnage in the pieces that follow.

Wind costs will remain high

Net Zero Watch

Gordon Hughes

26 June 2023

The crash in Siemens Energy’s share price on Friday has admirably highlighted an issue with wind costs that colleagues and I have been examining for more than a decade. The painful facts are that (i) wind generation, both onshore and offshore, is more expensive than we are being told and (ii) the performance of wind turbines tends to deteriorate with age, in significant part because of the kind of failures reported by Siemens Energy. There is strong evidence to support these conclusions, which has been presented in reports published by the Renewable Energy Foundation in 2012 and in 2020 for the UK and Denmark, with updates provided by the Global Warming Policy Foundation and Net Zero Watch.

The news about Siemens Energy brings a strong inclination to say ‘you were warned’. However, their travails are a symptom of a much more widespread disease, which affects all of us, either directly through the costs of electricity or indirectly as the owners of wind farms (via pension funds and other investment vehicles). The plunge in the share price of Siemens Energy is dramatic, but that may be written off as a temporary market response to disappointed expectations. We need to look beneath the immediate story to understand the reasons for the disappointment and their implications for the prospects for wind generation.

The announcement by Siemens Energy focused on higher-than-expected failure rates for their onshore turbines. These were ascribed to problems with key components, but newspaper reports suggest more systematic design faults in recent generations of large turbines. Previous announcements have referred to problems with offshore turbines, and the market reaction suggests few believe that the current problems are confined to onshore turbines. Further, while each of the major turbine manufacturers has its own specific problems, Siemens Energy is not unique in experiencing high warranty costs due to higher than anticipated failure rates.

In increasing order of importance, there are three aspects to note:

(a) Siemens Energy and other manufacturers have given warranties on performance that won’t be met because of higher failure rates. They will incur additional expenses, either to replace components or to compensate wind farm operators for any resulting underperformance. Those costs are the basis for the write-offs that Siemens Energy has had to take. Investors will be painfully aware that the company has been declaring profits when they sell wind turbines, but without making adequate provision for future warranty repair costs.

In accounting terms this is known as recognising future profits for new contracts. When it becomes clear that the contracts will be less profitable, the company must write down the value of previously reported profits and, thus, the value of the assets on its balance sheet. In effect, though perhaps entirely innocently, the company has been misleading investors about its past and current profitability. Senior managers should be feeling very uncomfortable about their positions since the problem was predictable (and predicted).

(b) Warranties have a limited period – often 5 to 8 years – but the higher failure rates will persist and affect performance over the remainder of the life of the wind farms where the turbines have been installed. Their future opex costs will be higher than expected, and their output will be significantly lower. This will reduce their operational lifetimes, which are determined by how the margin between revenues and costs changes as wind farms get older. Lower revenues and higher costs bring forward the date at which replacement or repowering is necessary. These changes will reduce, often quite substantially, the returns earned by the financial investors – pension funds and other – to whom operators sell the majority of the equity in wind farms after a few years of operation.

(c) Siemens Energy and other manufacturers may argue that they can – with time – fix the component and design problems which lead to high failure rates. They may well be correct. The history of power engineering is littered with examples of new generations of equipment which experienced major problems when first introduced but which were eventually sorted out. Many companies have found themselves in severe financial difficulties or even forced into bankruptcy by these “teething” problems. The error in this case has been to pretend that wind turbines were immune to such failures.

The whole justification for the falling costs of wind generation rested on the assumption that much bigger turbines would produce more output at lower capex cost per megawatt, without the large costs of generational change. Now we have confirmation that such optimism is entirely unjustified – the whole development process has been a case of too far, too fast. Again, this was both predictable and predicted. The idea that wind turbines are immune to the factors that affect other types of power engineering was always absurd. The consequence is that both capital and operating costs for wind farms will not fall as rapidly as claimed and may not fall significantly at all. It follows that current energy policies in the UK, Europe and the United States are based on foundations of sand – naïve optimism reinforced by enthusiastic lobbying divorced from engineering reality.

In the longer term it is (b) and (c) that are the big story. With respect to (a), serious analysts have long since recognised that claims made about future wind costs and performance by the wind industry should not be taken seriously. It has been obvious that they were kidding themselves and their investors ever since the last 2010s. Unfortunately, we have now been tied into a high energy-cost future, with all the implications that has for the economy and standards of living.

Net Zero Watch

Still Waiting For The Magical Future Of Free Wind Power

Manhattan Contrarian

Francis Menton

26 June 2023

Wind power: It’s clean. It’s free. It’s renewable. Google the subject, and you will quickly find fifty articles claiming that electricity from wind is now cheaper than electricity from those evil, dirty fossil fuels. So why doesn’t some country somewhere get all of its electricity from wind?

In fact, despite now several decades of breakneck building of wind turbines, no country seems to be able to get even half of its electricity from wind when averaged over the course of a year, and no country has really even begun to solve the problem of needing full backup when the wind doesn’t blow.

Germany is the current world champion at trying to get its electricity from wind. (It also gets a small contribution from solar panels, but since it is the world’s cloudiest country, those don’t help much.). According to Clean Energy Wire, December 2022, in 2020 Germany got 45.2% of its electricity from wind and sun. Then that declined to 41% in 2021, due to lack of wind. In 2022 they appear to have bounced back to 46%. Germany has enough wind turbines that they produce big surpluses of electricity when the wind blows at full strength. But they still haven’t cracked the threshold of meeting 50% of electricity demand with wind and sun over the course of a year.

It’s no better over in the territory of co-climate crusader UK. Despite a crash program to build wind turbines (also accompanied by a smidgeon of solar panels), the UK’s percent of power from wind in 2022 was 26.8%, according to the BBC on January 6, 2023. Solar added a paltry 4.4%.

Well, maybe this project isn’t as easy as the central planners thought it would be. News of the past week brings to light a few more speed bumps on the road to energy utopia.

At the website Not A Lot Of People Know That, Paul Homewood on June 21 presents a calculation for the UK of how much wind turbine capacity would be necessary to supply the country with all its electricity needs by building extra wind capacity and using it to electrolyze water into hydrogen. The calculation was initially prepared by a guy named John Brown, and provided to Paul. For those interested in reviewing the calculation, it is available by emailing Mr. Brown at jbxcagwnz@gmail.com.

For starters, Homewood notes that average demand in the UK was 29 GW in 2022, and it has 28 GW of wind turbine capacity already. As you can immediately see, the fact that 28 GW of “capacity” only supplied 26.8% of average demand of 29 GW indicates an average capacity factor of under 30% for the wind turbines. The total demand for the year came to 262 TWh, but the wind turbines only produced 62 TWh.

Brown then calculates how much wind turbine capacity would be needed to generate enough electricity to supply all of the demand, either directly, or by electrolyzing water to make hydrogen and burning the hydrogen. He comes up with 370 TWh of total production needed from the wind turbines — 262 TWh to supply existing demand, and another 108 TWh for the various losses in the processes of electrolysis and then burning the hydrogen. The 370 TWh is about 6 times the current wind turbine capacity of the UK. Homewood:

The reason why the total generation needed, 370 TWh, is so much higher than demand is the hopelessly inefficiency of the hydrogen process. John has assumed that electrolysers work at 52% efficiency, and that burning hydrogen in a thermal generator works at 40% efficiency. Both assumptions seem reasonable. In other words, the efficiency rate for the full cycle is 20.8%. In simple terms, you need 5 units of wind power to make 1 unit of power from hydrogen.

Brown and Homewood do not go into detail on the costs of this project, other than to note that the cost of the wind turbines alone for the UK would be about 1 trillion pounds (or $1.3 trillion). Since the U.S. is more than five times the population, that would mean more than $6.5 trillion for us. And that’s before you get to the cost of building the electrolyzers for the hydrogen, the costs of transporting and storing the stuff, and so forth. Let alone dealing with doubling the demands on the grid by electrifying all home heating, automobiles, transportation, etc. A multiplying of costs of electricity by around a factor of 5 to 10 would be a good rough estimate.

In other words, this is never going to happen. The only question is how far down the road we get before the plug gets pulled. As I wrote in my energy storage report, the only thing to be said for hydrogen as the means of backup for a decarbonized economy is that it is less stupid than using batteries as the backup.

And in other news relating to the future utopia of wind power, we have a piece in the Wall Street Journal of June 23 with the headline, “Clean Energy’s Latest Problem Is Creaky Wind Turbines.” The first sentence is “The ill wind blowing for clean-energy windmills just got stronger.” The article reports that shares of German wind turbine giant Siemens Energy fell 36% on Friday after the company withdrew profit guidance for the rest of the year and stated that components of its installed turbines are wearing out much faster than previously anticipated. Thus costs of fulfilling warranties will greatly increase; but also, the expected replacement cycle for the turbines needs to be shortened. The writer (Carol Ryan) comments,

“The news isn’t just a blow for the company’s shareholders, but for all investors and policy makers betting on the rapid rollout of renewable power.”

Barron’s on the same date (June 23) quotes the CEO of Siemens wind turbine subsidiary Siemens Gamesa as follows:

In a call with reporters, Siemens Gamesa CEO Jochen Eickholt said “the quality problems go well beyond what had been known hitherto. . . . The result of the current review will be much worse than even what I would have thought possible,” he added.

And then there’s the comment from parent company CEO Christian Bruch:

In the call with reporters, Siemens Energy CEO Christian Bruch called the developments “bitter” and “a huge setback.”

Those are by no means the usual types of words uttered by ever-optimistic public company CEOs.

In the short run, don’t expect the climate doom cult to walk away from any of their grand plans. The immediate answer will be more, and still more government subsidies to keep the wind power dream alive. But at some point this becomes, as they say, unsustainable.

Manhattan Contrarian

Siemens Energy shares fall amid quality problems at wind turbine business

National News

Reuters

23 June 2023

Siemens Energy had €5.8 billion ($6.3 billion) wiped off its market capitalisation on Friday after warning that the impact of quality problems at its Siemens Gamesa wind turbine business would be felt for years.

The group scrapped its 2023 profit outlook late on Thursday after a review of its wind turbine division exposed deeper-than-expected problems that could cost more than €1 billion.

“This is a disappointing and severe setback,” Jochen Eickholt, chief executive of Siemens Gamesa, told journalists on a call.

“I have said several times that there is actually nothing visible at Siemens Gamesa that I have not seen elsewhere. But I have to tell you that I would not say that again today.”

Siemens Energy’s share price plunge on Friday was the biggest since the group, which supplies equipment and services to the power sector, was spun off from Siemens and separately listed in 2020.

Shares were down 31.5 per cent at 0842 GMT, with traders and analysts pointing out that the extent of the company’s latest problems was still uncertain.

“Even though it should be clear to everyone, I would like to emphasise again how bitter this is for all of us,” Christian Bruch, chief executive of Siemens Energy, told journalists in a call.

The company’s finance chief Maria Ferraro earlier told analysts that the majority of the hit would be over the next five years.

“Given the history and nature of the wind industry, the profit warning was not a complete surprise, but what surprised us was the magnitude,” analysts at JP Morgan said.

Siemens aims for more smart building and infrastructure deals in the UAE

Issues at Siemens Gamesa have been a drag on the parent for a long time, prompting Siemens Energy to take full control of the business after only partially owning it for several years.

The discovery of faulty components at Siemens Gamesa in January had already caused a charge of nearly half a billion euros.

Mr Eickholt said that while rotor blades and bearings were partly to blame for the turbine problems, it could not be ruled out that design issues also played a role.

Mr Bruch also blamed the corporate culture at Siemens Gamesa, the result of a merger of the wind turbine division of Siemens and Spain’s Gamesa, saying: “Too much has been swept under the carpet”.

He said that the setback from the quality problems was “more severe than I thought possible”. At the same time, he said he did not believe that the full takeover of Siemens Gamesa had been a mistake.

Mr Bruch said that the company would be able to provide a more accurate estimate of the costs from the latest problems by the time it publishes its third-quarter results on August 7, after a full analysis of the situation.

National News

Waiting for government bailout subsidies in 3…2…1.

As stated in the articles, the life of wind turbines through wear and tear and design flaws have always been questioned. Why should the CEO be surprised? Has he been living under a rock?

If you make useless things you become a useless company – your choice !!!!!