There are 30 countries where you’ll find nearly 450 nuclear reactors currently operating – including the French, Americans, Canadians, Japanese and Chinese. Another 15 countries are currently building 60 reactors among them. Nuclear power output accounts for over 11% of global electricity production. But not a lick of it in Australia, thanks to an idiotic legislated ban put in place by a Liberal government back in 1998.

STT promotes nuclear power because it works: safe, affordable, reliable and the perfect foil for those worried about human-generated carbon dioxide gas – because it doesn’t generate any, while generating power on demand, irrespective of the weather – unlike the forever unreliables: wind and solar.

And we are not here to draw divisions on the basis of scale; large or small, nuclear plants that deliver power as and when it’s needed are the natural energy choice, in an energy-starved world.

At the smaller end of the spectrum, the wind and solar cult run the line that SMRs are a pipe dream, cooked up by conservative reactionaries, doggedly ignoring their superior capability in the realm of naval propulsion.

Far from being a figment of conservative imaginations, 200 small nuclear reactors are presently powering 160 ships and submarines all around the world, and have been for decades.

Clearly sobering up after its disastrous dalliance with chaotically intermittent wind power, the UK government is finally getting serious about serious energy as Debra Rubin explains. In the piece that follows, it appears the Italians have also suffered a sudden bout of common sense, for much the same reason.

UK Ramps Up Outreach to Develop Small Nuclear Reactor Fleet

ENR

Debra K. Rubin

30 December 2022

The U.K. government’s push to develop more nuclear power as a cleaner energy alternative is going beyond its November buyout of China’s interest in the planned 3.3-GW Sizewell C plant and a new 50% stake in the firm developing the megaproject on England’s east coast.

The government also is seeking proposals from developer and construction sector teams for small modular nuclear reactor (SMR) technology to expedite its fossil fuel transition.

As part of an energy strategy announced last spring, Britain has committed to greater SMR investment and has formed Great British Nuclear to bring forward new projects to help meet a target of up to 24 GW of nuclear energy production capacity by 2050. This would represent an increase from 15% to about 25% of forecasted electricity demand, it said.

The government also has set up the Future Nuclear Enabling Fund to financially support new nuclear projects.

The smaller plants are set to generate between 50 MW and 300 MW of power, compared with the 1,000-MW-plus output from a conventional large reactor, and also make use of modular manufacturing approaches that reduce the construction risks of bigger structures. By comparison, SMRs have simpler designs, are safer to refuel and maintain, can be used to power large industrial sites or data centers and can produce green hydrogen, experts say.

SMR Competition Builds

London-based Balfour Beatty could be one of the first U.K. contractors to build an SMR in Britain. On Dec. 19, the contractor announced an agreement with the British arm of Jupiter, Fla.-based nuclear energy firm Holtec International, along with Hyundai Engineering and Construction, to support engineering and construction of the U.S developer’s SMR-160 pressurized light-water reactor in Britain. It would generate 160 MW of power.

“The United Kingdom is at a turning point as it navigates through this energy crisis,” says Richard M. Springman, Holtec International senior vice president. “It will need multiple, complementary nuclear power plant designs based on proven pressurized water reactor technology already operating … to assure carbon-free energy security in ten years, and we have to start now.”

Under the agreement, “the parties will develop the division of responsibilities for procurement, construction and commissioning of SMR-160 plants in the U.K.,” says Holtec. They will also “jointly develop a cost estimate for deployment of the SMR-160 in the U.K., based on Holtec’s standard design.”

Holtec plans to launch next year the government’s voluntary design acceptance process for its SMR that covers reactor safety, security, environmental protection and waste management. The process, for which it applied in November for funding support, is separate from site-specific plant licensing.

The firm plans to deploy 32 SMR units by 2050 that would amount to a capacity of 5.1 GW, with construction of the first unit targeted to start in 2028.

Holtec has identified three potential sites in the U.K.—two in England and one in Wales—“suitable for hosting the first wave of Holtec SMR-160s,” says Gareth Thomas, Holtec’s Britain director.

“We look forward to working with Holtec International to drive forward clean energy solutions,” says Stephen Tarr, Balfour Beatty’s CEO for major transport and energy projects.

Rolls Royce, GE and NuScale In Mix

London-based Rolls-Royce, a leading SMR developer in Britain, heads a consortium announced in 2020 that aims to build SMRs able to generate 470 MW, to be located at operating and former nuclear plant sites. Regulators are reviewing its design application, with U.K.-based engineer Atkins supporting the Rolls-Royce effort. Its consortium also includes Jacobs, as well as contractors BAM Nuttall and Laing O’Rourke. At the time, Rolls Royce said it had developed a production line process that has “reduced many construction risks associated with new nuclear power stations.”

The effort has been aided by more than $250 million of government funding and about $235 million in private investment.

The manufacturer also announced on Dec. 19 four potential U.K. locations for its small reactors and three shortlisted sites for factories that will produce modules and components for SMR site assembly.

Rolls-Royce anticipates U.K. regulatory approval by mid-2024 and hopes to connect its first plant to the power grid by the early 2030s.

According to the firm, about 90% of manufacturing and assembly activities would be done in a factory, with energy generation from finished SMR units of about 15 GW. The first Rolls-Royce SMR would cost $3 billion, but this would drop to $2.4 billion for subsequent facilities, says the company, which wants formal negotiations with the government over possible funding models, according to Financial Times.

Another contender to site SMRs in Britain is North Carolina-based GE Hitachi Nuclear Energy, which also recently announced submission of a design assessment application for government review. The developer says it seeks to develop its BWRX-300 plant that would generate 300 MW and leverage aspects of GE’s larger boiling-water reactor technology.

The design is undergoing pre-licensing review by the Canadian Nuclear Safety Commission. The Tennessee Valley Authority is considering it as well.

“Through the [British design review] process, we look forward to engaging U.K. regulators and enabling collaboration with their global counterparts,” says Sean Sexstone, GE Hitachi executive vice president for advanced nuclear.

GE Hitachi says it has been supported in the design review process by Jacobs UK, which has been involved in licensing applications for new nuclear power plant projects since 2007.

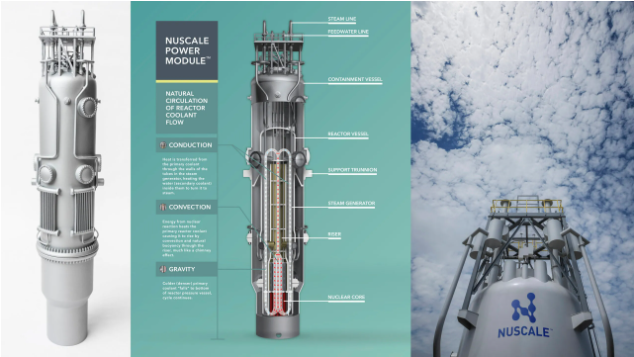

NuScale Power Corp., another U.S. small reactor developer and the first to have U.S. Nuclear Regulatory Commission design approval, also is set to launch its technology in the U.K.

“NuScale is a front-runner in SMR development … and has developed a small module reactor that generates up to 77 MW using 1% of the space of a conventional reactor,” says Marc Deschamps, co-head at boutique investment bank DAI Magister.

“We view ourselves as probably the most near-term deployable technology and the most mature program of any of the SMR vendors in terms of overall development and maturity,” Tom Mundy, NuScale unit president, told U.K. publication New Civil Engineer. While noting uncertainties as to how SMR developers would operate within the Great British Nuclear framework, he said the firm will “continue to push forward and hopes to see our technology be part of the overall energy equation in the U.K.”

Texas-based contractor Fluor Corp. has 57% ownership of NuScale.

But NuScale, as well as other developers and market observers, is watching how rising inflation and other economic gyrations are affecting project development costs and progress.

On its planned SMR project in Utah, which would include six 77-MW reactors for a group of 50 Western state municipal utilities that is set to operate in 2029, NuScale noted steep hikes in steel plate and piping, among other rising project costs. The increases could boost the utilities’ agreed-to power supply price—triggering a possible contract renegotiation or even project abandonment, according to minutes of one utility member’s recent meeting.

“We are prepared to help customers evaluate how inflationary pressures can impact potential clean energy projects,” John Hopkins, NuScale CEO, said in a note to stakeholders and investors.

ENR

Italy may “Build Back Nuclear” — not quite the Great Reset the Greens or Financial Houses had in mind?

Jo Nova Blog

Jo Nova

2 January 2023

The government of Italy is planning to build new nuclear power plants. And if it happens, it marks an astonishing turnaround.

This was the Garigliano Nuclear Power plant in Italy in 1970. They already had the solution to it all, energy wars, Vladimir Putin, and fantasy “climate control” fifty years ago.

But Italy abandoned nuclear energy thirty years ago. It’s the only major European country to have stopped using nuclear power. (Though Germany is trying to).

Italy had four nuclear plants in the early 1980s but after the Chernobyl accident, they held a referendum on nuclear power, and the voters didn’t want it anymore, so they closed the last two reactors by 1990, (back in the days when voting made a difference). Furthermore, Italy held another referendum in 2011, and 94% of the voters rejected it again, which shows how desperate the situation must be now if an opinion poll like that has shifted so far in 11 years?

The thing is, Italy only makes 25% of its energy itself, and so it is suddenly very attuned to “geopolitical risk”.

Pierre Goselin at NoTricksZone found a news piece on this Nuclear U-turn in the Berliner Morgenpost. Otherwise, it’s crickets from the worlds media.

Nuclear power: Italy is planning a turnaround in energy policy

Morgenpost

Micaela Taroni

10 December 2022

Under the pressure of the energy crisis, however, the Italians suddenly became painfully aware of their heavy dependence on electricity from abroad. The topic moves the citizens because they clearly feel the increase in their electricity bills despite government support.

Although renewable energies have been significantly expanded in recent years, the production of green electricity is far from sufficient.

No wonder that the new government around the right-wing populist Giorgia Meloni regards the return to nuclear energy, which the Italians had renounced following a referendum in 1987, as a solution to the energy problems.

The Infrastructure Minister (who happens to lead the second largest party in the Coalition) is dead keen:

“Italy cannot be the only major country in the world without nuclear energy. We cannot talk about phasing out gas, petrol and diesel without discussing nuclear energy,” [Matteo] Salvini explained, proposing that a nuclear power plant could be built in Milan, in his Baggio district.

When environmentalists objected that Italy was a densely populated country prone to earthquakes, landslides and floods, and on whose soil it would be better not to build nuclear reactors, Salvini replied that there were 440 nuclear reactors in operation worldwide, including several in seismically active Japan and a dozen of them in France, just over the Italian border. “Reactors of the latest generation are the safest and cleanest form of energy production, that’s the future,” assured the Lega boss.

As usual, the left-leaning parties that want to reduce emissions will do anything to Not achieve that. Apparently, the big problem with nuclear power is that even though it will solve their emissions fears, it won’t meet some arbitrary committee deadline that no one else is going to meet anyway:

The Social Democrats see this “green transition” as an opportunity for the country’s economy. They oppose nuclear energy because, in their view, the timeframe and existing technologies are incompatible with a significant reduction in CO2 emissions by 2030.

Morgenpost

It’s almost like the Social Democrats are just the useless minions for the big bankers or the renewable industry. What they fear more than the climate catastrophe is the end of their fake crisis.

So the big question then, is will Italians accept a nuclear plant now?

(The translation here is just from Chrome, don’t blame Pierre! )

The World Nuclear Association has more information on Nuclear Power in Italy.

Jo Nova Blog

Heh, so now it’s changed from “Atomkraft – nein danke!” to “Atomkraft – ja bitte!”

That’ll upset the bedwetters.