Power-starved Brits and Germans will soon tell you how important having power on demand truly is. And they’ll also tell you what it’s like to receive a power bill that you’ve absolutely no hope of paying.

After years of telling us how cheap and easy our inevitable transition to an all-wind and sun-powered future would be, with examples like Germany and Britain, the story is beginning to fall flat.

Rather than some brightly lit Nirvana, our wind and solar-powered future is looking more miserable by the day.

As they say in politics, the mob soon works you out.

Well, the number who have identified the scale and scope of the great renewable energy fraud is growing, and they’re growing angrier by the day. Something has to give.

Michael Shellenberger isn’t alone in his view that the days of the West’s obsession with wind and solar are numbered.

End Of Renewables Craze Is Near

Substack

Michael Shellenberger

9 September 2022

The global energy crisis appears to have strengthened the resolve of Western political leaders to not just continue but accelerate the transition toward green energy. Last month, U.S. President Joe Biden signed legislation that aims to spend $370 billion on wind, solar, electric cars and other forms of green tech. California legislators and regulators recently decided to spend $54 billion on clean tech, restrict oil and gas drilling, and ban the sale of internal combustion cars by 2035. And the President of the European Commission affirmed yesterday the European Union’s “massive investments in renewables” because “they are cheap, they are home-grown, they make us independent.”

But appearances can be deceiving. In truth, the energy crisis is rapidly exposing the limits of renewables and the need for fossil fuels. Recognizing the political threat of high gasoline prices, Biden has released so much petroleum from the public’s Strategic Petroleum Reserves that they are at their lowest level in nearly 30 years. Six days after California regulators banned the sale of internal combustion engines, the state’s grid operator urged residents to not charge their electric vehicles from 4 pm to 9 pm for fear of blackouts. And European governments will spend over $50 billion this winter on new and refurbished coal and natural gas supplies and equipment.

Officially, governments and corporations are still moving ahead with big investments in renewables and electric vehicles (EVs). Globally, solar installations in 2022 will rise at their fastest pace in nearly a decade. Toyota and Honda announced they would spend $2.5 billion and $4.4 billion, respectively, on EV battery manufacturing in the U.S., Piedmont Lithium said it would build a plant to process lithium for EVs. in Tennessee, and First Solar announced $1.2 billion for a new U.S. solar panel factory. California will spend $6.1 billion on EVs. And Europe has not pulled back from the $210 billion in new money it promised to invest, mostly in renewables, over the next five years

But other data complicate that picture. Fossil fuels remain 82% of global primary energy, down from 83% in 2019 and 85% in 2017. Solar and wind supply just 5% of global energy. And there are so few EVs that they reduce petroleum consumption by just a half percent of global demand.

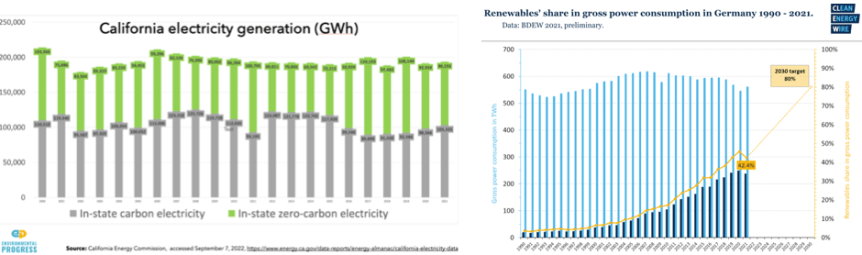

Meanwhile, places with heavy renewables penetration are reaching their limits. The amount of zero-carbon electricity California generated declined by 10% over the last decade, because of less hydroelectricity from drought, and the 2011 closure of San Onofre nuclear plant, which was 9% of the state’s total electricity generation. In Germany, the total amount of electricity from renewables declined in 2021, even as overall electricity consumption rose.

California invested billions in batteries to prevent blackouts and is thus proof that batteries are no substitute for natural gas. To store just 12 hours of electricity for the U.S. would cost $1.5 trillion, notes analyst Mark Mills, in an essential new Manhattan Institute report, “and that scale of storage would still leave the nation regularly third-world dark.”

And rising energy prices, public debt, and the far higher materials requirements of renewables will make them prohibitively expensive, in many places, over the next decade. Solar and wind energy projects require roughly 300% more copper and 700% more rare earths than fossil fuels, per unit of energy. Wind, solar, and batteries require 1,000% more steel, concrete and glass; 300% more copper; and 4,200%, 2,500%, 1,900%, and 700% more lithium, graphite, nickel, and rare earths, respectively, than fossil fuels, to produce the same amount of energy, according to International Energy Agency and others.

Why is that? And what does it mean for the future of energy?

Substack

HURRAY !!! The truth at last ! Hopefully, the net zero dream is over ??

“Clean Green Energy”

What exactly has so-called “clean green energy” wind power and solar photovoltaics achieved for the climate since their introduction decades ago ?

Such and similar questions must be asked again and again now and in the future.

“Wind, solar, and batteries require 1,000% more steel, concrete and glass; 300% more copper; and 4,200%, 2,500%, 1,900%, and 700% more lithium, graphite, nickel, and rare earths, respectively, than fossil fuels”

And an infinite supply of Unobtanium…

Arizona is on that bandwagon with a new project south of I-40 in Navajo County called West Camp Wind Farm that will devour a whopping 82 square miles of land. The developer claims 30 regular jobs yet the state shut down the coal plant that had 265 jobs and used 1/82nd that amount of land. Coal is mined by the Navajo tribe and sent to China. 104 giant 820 foot tall turbines! Chevelon Canyon Ranch surrounded!