The chaotic delivery of wind and solar has left Australia’s Eastern Grid on the brink of collapse. The Eastern Grid connects Queensland, New South Wales, the ACT, Victoria, Tasmania and South Australia.

Reliable coal-fired generators have been knocked out of the game, made uneconomic thanks to renewable energy policies that direct more than $3 billion a year in subsidies to wind and solar, and which give wind and solar preferential access to the grid.

The most recent losses – Victoria’s Hazelwood and South Australia’s Northern power plants – resulted in the removal of more than 2,200 MW of reliable supply, at a time when Australia needs it most.

When the sun sets and/or calm weather sets in, wind and solar power output collapses, like night follows day.

That (now routine) chaos has two immediate consequences: spot prices for power go through the roof; and the grid manager starts ‘dumping load’. For power punters, ‘dumping load’ manifests as load shedding (controlled blackouts) and sometimes blackouts involving less deliberation and design.

The renewable energy zealots that hijacked Australia’s Energy Market Operator are less than candid about that relationship.

STT, on the other hand, is only too happy to spill the beans – eg: Wind Power Output Collapses Send Power Prices into Orbit: The World’s Biggest Joke Just Got Serious

The very real and pressingly imminent threat of a total ‘system black’ across the entire Eastern Grid this summer has finally focused thinking amongst Australia’s political betters.

The chaos delivered by wind and solar has them fretting, for very good reason, that the eastern states will end up suffering mass load shedding and blackouts of the kind that rendered South Australia (Australia’s wind and solar capital) the butt of international jokes.

King coal surges 60pc as ministers agree to work on reliable power

The Australian

Joe Kelly

26 October 2018

Coal has emerged as the nation’s most valuable resource commodity — increasing in value by almost 60 per cent over the past five years — as states and territories agree to a December timeline for a deal to make electricity supply more reliable.

Following a meeting with his state and territory counterparts yesterday, federal Energy Minister Angus Taylor said progress had been made on a key element of the now-scrapped national energy guarantee, the “reliability obligation”. The obligation, to be implemented by mid-2019, would help to shore up stability of the energy system by requiring retailers to contract ahead to guarantee supply during forecast shortfalls.

State and territory energy ministers used the Council of Australian Governments’ Energy Council meeting in Sydney to agree to consider a draft bill in December establishing the new obligation amid concern about the security of supply over summer. “The reliability obligation is absolutely crucial,” Mr Taylor said. “We know this summer we’re facing some real challenges.”

Australian Energy Market Operator chief executive Audrey Zibelman briefed the ministers on preparations to buttress the security of supply in the national electricity market over the Christmas holiday period. AEMO warns of the need for “additional measures” to guarantee greater reliability.

Its warning coincided with the release of a new data series from the Australian Bureau of Statistics yesterday showing that coal mined in Australia in 2017-18 was valued at $65.6 billion, up from $41.4bn in 2013. “This is the first time that statistics for output (by commodity) and intermediate use of inputs have been published for the mining industry,” the ABS said.

Queensland Resources Council chief executive Ian Macfarlane said the data showed the mining industry added 8.8 per cent of the value of the Australian economy in the past financial year compared with 4.7 per cent in 1994-95.

“In 1994-95, Australian coal production was worth $8.8bn, compared with an incredible $65.6bn in June this year,” he said.

Gas production also increased dramatically over the past five years, rising from $22bn in 2013 to $46.5bn in 2018. In 1994-95, gas production was worth $2.6bn.

Resources Minister Matt Canavan seized on the results, saying it was “another reminder that Australia’s mining industry remains crucial to our nation’s wealth”.

“Fossil fuel exports from Australia are helping our economy maintain positive growth and get the budget back into surplus,” he said. “Just in the past two years, coal and gas exports have surged by $50bn — that’s equal to our entire exports of agriculture.”

The growth coincides with a debate over a new government plan to shortlist a “pipeline” of potential baseload power generation projects, including new clean coal stations, by early next year. The projects would be eligible for government assistance under a scheme being designed. Mr Taylor has signalled the government could potentially indemnify a new coal project against the risk of a future carbon price.

A government plan to establish a “default market offer” against which energy retailers would set their prices was also discussed at the Energy Council meeting. The ministers agreed on the “need to develop a reference point/comparison rate against which all offers could be measured”, for consideration in December.

The Australian

While the risk of blackouts this summer is front of mind for those who will have to face the music when the lights go out, there’s the not insignificant issue of what happens to wholesale power prices.

Already facing serious reserve capacity shortfalls, when wind and solar power output collapses (think breathless 42° C afternoons, as the sun sets) the spot price for power takes an exponential trajectory around $100 per MWh, all the way to the regulated market cap of $14,200.

The consequence is even more retail power price punishment for households and businesses.

Here’s The Australian’s Judith Sloan digging even deeper into that dilemma.

No end in sight to electricity consumers paying for poor policy

The Australian

Judith Sloan

26 October 2018

We were staying in a Queensland country town a few weeks ago. I got talking to the owner of the local bakery. He was looking at his latest financial statement that the accountant had sent through. And there it was in black and white. His annual power bill last financial year was $114,000. It had been a tad over $30,000 two years before.

He employs 30 people, some on a part-time basis. Business seemed to be brisk but it’s hard to put up the price of pies and buns too much without demand dropping.

It’s easy to concentrate on the impact of rising electricity prices on households. And let’s be clear on that score. In real terms, the average retail price of electricity over the 10 years ending in 2017-18 rose by 51 per cent and the average retail bill rose by 35 per cent (people have used less electricity, in part because of the higher prices).

But for many small and medium-sized businesses, the increase in their electricity bills has been higher again. Many are exposed to the full variations in wholesale prices, which have risen from less than $40 a megawatt hour to more than $100/MWh before settling around the $70 to $80/MWh mark. This threatens the viability of a number of businesses.

It’s hardly surprising the federal government has decided to focus on getting electricity bills down. Let’s be clear about reduced emissions and the commitment the government has made to the Paris climate agreement — the target in respect of electricity will be met by the early 2020s. Every participant in the industry acknowledges this.

It’s one of the reasons why the emissions reduction target that was part and parcel of the now defunct national energy guarantee was superfluous. Note also there was considerable manipulation going on of the precise details of this target to suit the activist ambitions of those promoting the NEG. The only part of the NEG now worth saving relates to the reliability obligation, which is likely to become binding much sooner than generally expected.

For those who complain about a decade of energy policy paralysis, the truth is there has been a constant and active government policy position over that time. Renewable energy sources have been massively promoted, favoured and subsidised.

The renewable energy target, which remains in force until 2030, has spun off subsidies to renewable energy generators to the tune of about $80/MWh (the value has been higher in the past) through large-scale generation certificates. The value of these LGCs is expected to drop but not for several years.

In addition, there have been the interventions of reverse auctions run by state governments and the ACT that provide guaranteed cash flow for renewable energy projects. There are also the rules in the National Energy Market that give preferential dispatch to renewable energy generators. And there are the mountains of subsidies available through bodies such as the Clean Energy Finance Corporation and the Australian Renewable Energy Agency.

Estimates put the value of the subsidies paid to the renewable energy sector at between $2 billion and $3bn a year, paid by consumers and taxpayers. That’s not policy paralysis; that’s policy promotion of a particular sector. If we ignore the decimation of the business models of dispatchable power generators and the much higher electricity prices we have had to pay, arguably the policy has worked. It is estimated that $2bn was invested last year in renewable energy generation — a record amount. And this year the boom has been even bigger.

The Clean Energy Regulator has released information that 34 renewable energy power stations with a combined capacity of 667MW were accredited last month, which was the largest single month of solar and wind capacity since April 2001. Nearly 2800MW has been accredited so far this year, compared with the previous annual record set last year of 1088MW.

The CER also notes about 1600MW of rooftop solar will be installed this year — the six panels every minute scenario mentioned by Audrey Zibelman of the Australian Energy Market Operator — which is up 44 per cent on last year. There are now more than three million small-scale installations. Note there are also about 40,000 commercial solar systems.

Now, if renewable energy could provide reliable electricity at affordable prices, these trends would be great. But even on the most optimistic estimates of the boosters of renewable energy, wind can produce at most 50 per cent of the time and solar at 30 per cent. This produces a very large shortfall that has to be covered by firming capacity. Batteries and pumped hydro don’t come close to filling the gap and are unlikely to do so for many years.

And here’s another thing that needs to be considered when observing the boom in renewable energy investment: 10 coal-fired power stations with a total capacity of more than 5000MW have left the grid since 2012. None of these stations has been replaced.

What is beginning to emerge is a crisis affecting the grid that makes up the National Electricity Market, which covers South Australia, Victoria, NSW, Queensland, Tasmania and the ACT. This is being recognised by AEMO, which worries about the reliability of the grid in general and the possible shortfall of power in South Australia and Victoria at certain times during the coming summer.

The NEM electricity grid has always been long and skinny. It is now longer and skinnier, with far too much unreliable renewable energy and far too little firming capacity. This is the principal reason why federal Energy Minister Angus Taylor is so focused on getting more firming capacity into the system to back up the runaway investment in renewable energy.

It is also why he has decided to take a resolute line with the large “gentailers” — think AGL, Origin and Energy Australia — whose behaviour has contributed to the growing fragility of the system as well as to rising prices. The companies are quite capable of manipulating the market while promising to invest in firming capacity but never quite following through with their plans.

Of course, in a normal competitive market government should always refrain from intervening to force down prices. But the electricity market is not a normal market. Apart from the fact electricity is an essential service, the high degree of market concentration almost certainly means prices are higher than they should be. The egregious behaviour of the retail divisions of the gentailers, by dudding loyal customers in particular, indicates they cannot be trusted. Just ignore their howls of complaints about the downsides of regulation. By setting a reference price for standing offers, this will force down prices more generally, and the companies know it.

By bringing more dispatchable power into the system as quickly as possible — another focus of Taylor — wholesale prices will hopefully fall, bringing further price relief for customers. The truth is the gentailers have been feasting on high wholesale prices. Surely no one will complain if the government offers the same cost of capital to new dispatchable power plants that is available to intermittent renewable energy plants?

With all this new renewable energy coming into the market, there is a real question mark over the commercial viability of some of the projects. When the wind is blowing and the sun is shining, wholesale prices can be driven to low levels. Clearly, the backers of these projects are basically betting on the election of a Labor government to impose a higher emissions reduction target and a reinstituted RET. In this scenario, we would expect electricity prices to resume their upward trajectory.

The NEM is in disarray, but let’s not kid ourselves that this is because of policy paralysis. This is because of incredibly poor policy where the consequences in terms of price and reliability were completely foreseeable. The challenge for the federal government is how to pull us back from this abyss.

The Australian

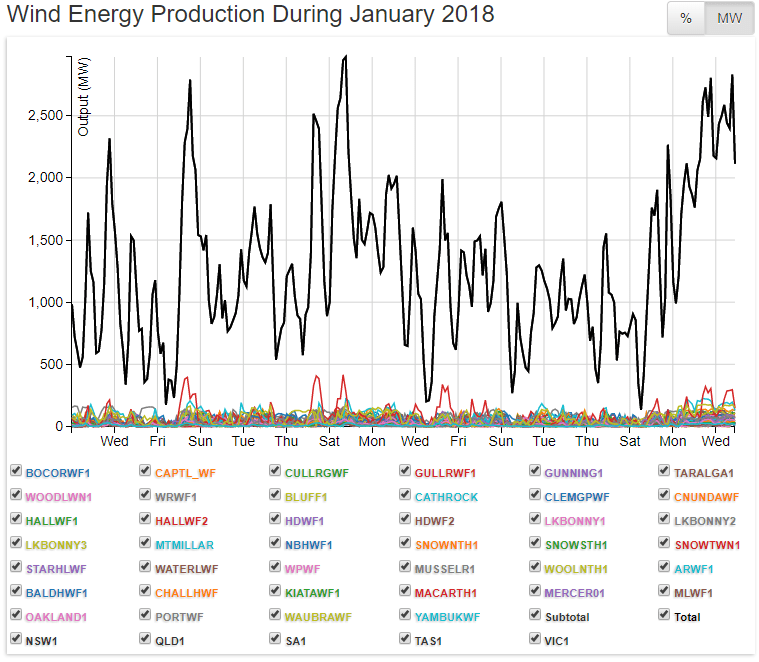

By the way Judith, your line that “wind can produce at most 50 per cent of the time and solar at 30 per cent”, is out by a mile.

The average capacity factor – the net capacity factor of a power plant is the ratio of its actual output over a period of time, to its potential output if it were possible for it to operate at full nameplate capacity continuously over the same period of time – for solar in Australia is around 24%. For wind power, across the entire Eastern Grid, the figure is 28%.

Those numbers mean that, on average, more than 70% of the time all electricity generated in Australia is coming from coal, gas and hydro. When the sun sets and/or calm weather sets in this summer, householders without their own generators will be left scrambling for candles. Welcome to your wind powered future!

Reblogged this on "Mothers Against Wind Turbines™" Phoenix Rising….

The Netpower gas plant produces zero co2 emissions. Testing has been successful and they are hoping to build them commercially by 2021.

https://www.netpower.com/

Sabotage.

verb

verb: sabotage; 3rd person present: sabotages; past tense: sabotaged; past participle: sabotaged; gerund or present participle: sabotaging

1. 1. deliberately destroy, damage, or obstruct (something), especially for political or military advantage.”power lines from South Africa were sabotaged by rebel forces”

2. synonyms:

3. wreck, deliberately damage, vandalize, destroy, obstruct, disrupt, cripple, impair, incapacitate”a guerrilla group sabotaged the national electricity grid”

4. disrupt, spoil, ruin, wreck, undermine, filibuster, impair, damage, threaten, subvert;informalthrow a spanner in the works of, muller; informalthrow a monkey wrench in the works of ”it would be very easy for me to sabotage your plans”

noun

noun: sabotage

1. 1. the action of sabotaging something.”a coordinated campaign of sabotage”

2. synonyms:

3. wrecking, deliberate damage, vandalism, destruction, obstruction, disruption, crippling, impairment, incapacitation; Morerareecotage ”the fire may have been an act of sabotage”

4. disruption, spoiling, ruining, wrecking, undermining, filibustering, impairment, damage, subversion;informala spanner in the works; informala monkey wrench in the works ”this procedure is open to sabotage by an awkward participant”

https://www.google.com.au/search?q=sabotage+meaning&ie=UTF-8&oe=UTF-8&hl=en-au&client=safari

The health problem of wind projects has now been identified by WHO. The Wind Commissioner is scrambling not to lose influence. It is imperative that he pays no part in adjusting guidelines: why should he? He has been been happy with guidelines in the people damage mode up to now.

Minister Taylor needs to “adjust” the Commissioner’s position.

Why are we not facing the subsidies problem and the favoured entry of renewables into the grid? This is at the absolute core of the high power cost problem

One way of breaking the matters of health and subsidies is to stop subsidies to wind projects that are causing health problems which have to be fixed before the mandated subsidies are returned.