Only the Germans could come up with a single word to capture the churlish sentiment of feeling a sense of malicious glee at another’s downfall. However, to STT the gleeful component of ‘schadenfreude’ is tempered with the realisation that there is no escape for any Australian from the debacle, in which South Australians now find themselves mired for practical eternity.

South Australia’s power supply and pricing calamity was inevitable and perfectly predictable – STT was spelling it out 3 years ago: The Great Watt and Pole Swindle and It’s only a RORT if you’re not in on it

As the mainstream press continued to throw the spotlight on South Australia’s energy debacle, its witless Energy Minister, Tom Koutsantonis resorted to punch-drunk threats to his counterparts in other states that the disaster playing out on his own patch will soon befall them too. It’s the one point on which Koutsantonis is absolutely right.

The Large-Scale RET is a national disaster, just waiting to happen; and, apparently believing they are, somehow, immune to basic economics, Queenslanders and Victorians are rushing to the head of the business and household slaughterhouse queue. Queensland and Victoria are run by certifiable Labor lunatics, hell-bent on beating SA’s wind power ‘scorecard’ – both pumping their own ludicrous 50% renewable targets.

Now, South Australian business leaders are screaming much the same warning to their interstate brethren.

SA move into renewables a ‘train wreck’

Australian Financial Review

Mark Ludlow

21 July 2016

Senior business leaders and peak industry bodies have warned the South Australian energy crisis could spread to the eastern states if they embrace wind and solar with the same gusto as the Weatherill government.

As big industrial users warned high power prices in South Australia were unsustainable, there is growing pressure on state and federal energy ministers to come up with a solution at the next Council of Australian Government’s meeting.

A major energy user in South Australia said the state’s energy crisis was self-inflicted, warning the over-reliance on renewable power sources such as wind and solar could have major ramifications for other states.

Lindsay Partridge, chief executive of Brickworks, blamed the headlong move into a greater concentration of renewable energy without taking into account the technical implications on “complete naivety and foolishness” on behalf of federal and state politicians and policymakers.

“We could have five or seven years of this,” he said, saying the problem was already spreading beyond South Australia to other states.

While there is an agreement the Renewable Energy Target – which has encouraged investment in wind and solar – was partly responsible for the energy security issues in South Australia, there is not the appetite to overhaul the scheme following a major review in 2014. But Mr Partridge said the RET was only part of the problem, pointing also to the opposition to developing onshore gas in Victoria and NSW, and Tasmania’s over-reliance on hydro.

Mr Partridge said federal and state policymakers needed to consider the technical and engineering difficulties of putting such a heavy reliance on intermittent generation.

He said the warnings had been around five years ago on the developing problem in SA and the eastern states: “It’s only going to get worse.”

Wind farms accounted for about one-third of South Australia’s energy in 2014-15. But the state’s energy users have experienced a “perfect storm” this month with high gas prices, problems with an interconnector with Victoria and intermittent wind output that has sent wholesale power prices soaring.

In response to the evolving crisis, which has seen the state’s wholesale electricity price spike to the maximum $14,000 a megawatt-hour, the South Australian government last week had to ask French-owned Engie to resume production at its mothballed Pelican Point gas-fired plant. It is also funding half of a $1 million feasibility study for a second interconnector cable between SA and the eastern states.

Australian Petroleum Production and Exploration Association chief executive Malcolm Roberts said South Australia was a “test case” for what could happen if wind and solar was chosen ahead of gas-fired alternatives.

He said state governments needed a more pragmatic solution to the transition to a low-carbon future, which would involve gas-fired power stations as back-up to wind and solar.

“You can turn a gas-fired power station on in 20 minutes – to generate enough power for as long as you need – and then you can turn it off. Neither coal or renewables can do that,” he told The Australian Financial Review.

Steve Masters, chief executive of SA power transmission grid owner ElectraNet, said part of the problem was the regulatory framework wasn’t keeping up with the pace of change in the energy supply mix and the heavier reliance on renewable power.

“If you go from federal policy to state policy to how regulations work in the electricity industry I’m not sure they’re in tune with each other,” he said. “The concern I have is if the regulations don’t keep up with the technology and changes in the market.”

The nation’s peak energy forecaster, the Australian Energy Market Operator warned in February about the unreliability of energy sources such as wind and solar.

Australian Financial Review

already grappling with a 90% power price hike.

***

Lindsay Partridge, CEO of Brickworks says “It’s only going to get worse.” Brickwork’s Austral Bricks plant was one of the thousands of South Australian businesses hit with a 90% hike in their power bills back in March this year: Wind Power Costs Crushing South Australian Businesses: Firms Hit with 90% Price Hike

STT hears that, due to SA’s crippling power prices, Brickworks is all set to close its South Australian brickmaking operations at Golden Grove and will, instead, make its bricks in New South Wales, trucking its product to SA, where its site will simply become a depot for sales, with the loss of dozens of manufacturing jobs: a ‘job’ being a rare and endangered species in SA.

Where Lindsay Partridge says “It’s only going to get worse”, he is absolutely spot on.

One reason is the fact that the “solution” being offered by the likes of Malcolm Roberts from the gas lobby (Australian Petroleum Production and Exploration Association) is really more of the same when he says: “the transition to a low-carbon future … would involve gas-fired power stations as back-up to wind and solar”.

As a gas pedlar, he would say that, wouldn’t he? Or as Upton Sinclair put it: “It is hard to get a man to understand something when his salary depends on his not understanding it.”

The wind cult continually chants that wind power means “death” to fossil fuels.

As STT has pointed out before, coal, oil and gas producers simply love wind power to bits. Diggers and drillers are not in the business of producing reliable, secure and affordable electricity, they’re in the business of selling coal, oil and gas. The chaotic (occasional) delivery of wind power is a Godsend to gas and diesel suppliers: Why Coal Miners, Oil and Gas Producers Simply Love Wind Power

Whether or not coal-fired plant are dispatching to the grid, they continually burn coal. And the ability to dispatch depends on whether the wind is blowing: if so, then heavily subsidised wind power knocks the conventional generators out of the game: South Australians Locked in Wind Power Price Disaster: Retail Prices Jump Another 12%

But coal-fired plant keep burning up the black or brown stuff at much the same rate – a delight for miners.

Perhaps Malcolm Roberts has been residing under a rock and missed the fact that South Australia’s present electricity supply is heavily reliant upon Open Cycle Gas Turbines – of the kind that Malcolm tells us that you can turn on “in 20 minutes – to generate enough power for as long as you need – and then you can turn it off”.

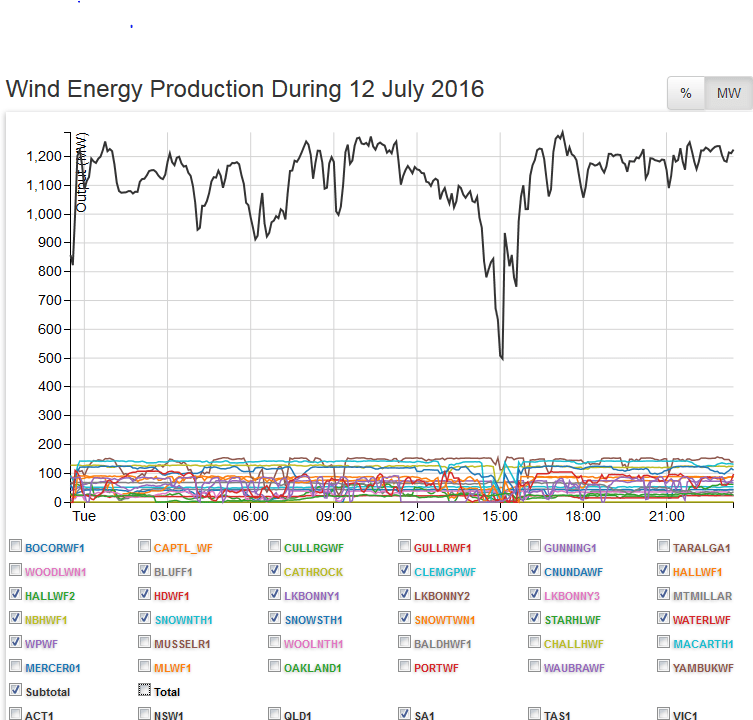

In fact, OCGTs – which are literally 747 jet engines – can be fired up in a few minutes and need to, to deal with colossal, unpredictable crashes in wind power output like the instantaneous 550MW collapse on 12 July, when hundreds of turbines where shut off in SA, during high winds to prevent their self-destruction:

OCGTs are highly inefficient and burn a phenomenal amount of gas (or kerosene or diesel – they can be run on all three) for every given MWh of electricity produced, when compared with their highly efficient Combined Cycle Gas Turbine cousins – the cost of keeping a grid up and running by relying on banks of OCGTs is just as phenomenal, as beleaguered miner, BHP can attest: South Australia’s Energy Fiasco: Wind Power Dropout Leaves BHP with Whopping $2.5 Million Power Bill

Over the last few weeks, Tom Koutsantonis has been blaming gas shortages, among other perceived enemies, for SA’s $14,000 per MWh wind power output collapse driven spot price spikes. It is true that the spot price of gas has been spiking, but that’s due, in part, to demand for gas from peaking power plants increasing around slumps in wind power output, as the owners of OCGTs fire them up to keep the grid from collapsing.

The need for fast-start up OCGTs to accompany the chaos of wind power is neither novel (as Malcolm Roberts seems to claim) nor is it a mystery – it was part and parcel of the wind power rort from the very beginning:

OCGTs (front) cash in at $14,000 per MWh.

***

The push by gas suppliers and/or the manufacturers and owners of OCGTs for more wind power capacity (backed up by their wares, of course) makes as much economic sense as open-cut miners using thousands of men armed with wheelbarrows, picks and shovels; instead of a handful of Caterpillar bulldozers, monster dump-trucks and their operators. Running grids with OCGTs, instead of CCGTs or coal/gas steam plants, makes no economic sense, either.

While South Australia’s political betters are moaning about their self-inflicted misery, sympathy for their plight seems pretty thin on the ground. Even the AFR’s editor was ready to lay the boots in.

SA energy madness

Australian Financial Review

Editorial

18 July 2016

There is something particularly indulgent about a state that demands massive handouts to sustain its uncompetitive manufacturing industries while at the same time indulging in a subsidised green energy push that makes those same industries even more uncompetitive. A month ago, The Australian Financial Review pointed to the policy dishonesty in federal Labor’s demands, fuelled further by Senate protectionist Nick Xenophon, that more taxpayers’ money be thrown at bailing out the old sub-scale Arrium steel-making plant in South Australia’s Whyalla. The clear lesson of Australian protectionism is that subsidising jobs in loss-making companies or industries simply imposes costs on more competitive companies and industries.

Now there’s an extra twist to the madness. The South Australian Labor government’s rush into renewable energy, particularly wind power, has forced coal-fired generation out of the state. But it also has helped generate a surge in South Australian electricity prices that is making the Arrium steelworks even more uncompetitive, as well as hitting the Nystar smelter in Port Pirie and BHP Billiton’s Olympic Dam giant copper and gold mine.

As we highlighted last week, the industry backlash has forced the state government to lean on owners of a mothballed gas-fired power station to crank up fossil fuel generation again in a desperate attempt to put a lid on wholesale electricity prices. But this can’t fully do the trick because the ban on gas exploration in states such as NSW and Victoria has collided with the liquefied natural gas export boom to strangle supplies of gas.

Remember, this is the state that politically demands the right to build the bulk of Australia’s next $50 billion submarine fleet. There might be a long-term fix if state-based east coast gas markets were fully connected or if battery storage technology improves. But this is a clear example of where bad public policy is being piled upon bad policy. If it continues, such indulgence will eat away at Australia’s modern prosperity.

Australian Financial Review

Ouch!! Not much sympathy to be found with the AFR. Indeed, the AFR’s rebuke is like the one that’s delivered to a bratty, know-it-all teenager by a long-suffering uncle, losing patience with his spoilt and annoying nephew.

That stinging riposte was echoed by Steve Wright from the Energy Resource Information Centre in the AFR’s letters.

Consumers pay the price for the wind rush

Australian Financial Review

Letters

21 July 2016

The editorial, SA energy madness (July 18), hit the nail on the head. Unfortunately, it is businesses and consumers who are paying the price for the rush into wind power, which is unable to meet baseload power needs.

As national energy market data shows, during last week’s electricity price crisis in SA, the state’s wind turbines were consuming more electricity than they were generating. When South Australian consumers and businesses needed more power to run their furnaces and warm their businesses and homes, the wind farms were not only failing to meet the need – they were making matters worse.

And the green lobby group the Australia Institute knows it. Its foot-stamping letter to the AFR (Batteries beat baseload, July 20) is not only wrong, it confirms the underlying problem: current renewables technology is more expensive, does not do the job and the result is a “complex and difficult” situation.

SA businesses who had to pay 100 times the usual price last week would undoubtedly agree on the “disruption” point. But they are unlikely to be convinced by the Australia Institute’s head-in-the-sand assurance that it will all be OK, because batteries will solve the problem. Perhaps new battery technology might help – one day. But it doesn’t now and nobody can say with any certainty when it might.

In the meantime, SA will simply have to suffer with the nation’s consistently highest electricity prices and the nation’s highest power disconnection rate; ie increasing costs for businesses and consumers, and energy poverty.

The only “rescue” option available for the government in last week’s crisis was to desperately urge the reopening of an inactive gas-fired generator.

Steve Wright, Energy Resource Information Centre

As Steve Wright observes, ‘consumers pay the price for the wind rush’. Indeed they do.

Lost among all the talk about new interconnectors (costing taxpayers $billions) and helpful ‘offers’ from gas suppliers and the owners of OCGTs to ‘save the day’ (at $14,000 per MWh, rather than $50) are tens of thousands of South Australians who either have no power because they are no longer able to afford it; or who struggle every single day to afford to light, heat and otherwise power their homes.

The AFR’s Ben Potter can fairly be regarded by STT’s followers as the ‘STT Rising Star of 2016’. Ben has not only come to grips with the scale and scope of the economic disaster being played out in South Australia, he is also equipped with a rare combination of an insightful, analytical mind and human compassion. Here’s Ben following the electricity grid to the skinny end of the line, where it really matters: a single mother with two kids battling to keep warm and keep the lights on.

SA single mum uses electric blankets and rugs to save on power

Australian Financial Review

Ben Potter

18 July 2016

As a single mother of two children on a modest income in Adelaide, Heather Merran can’t afford to let her $1000 a year power bill blow out.

So she has discovered that 100 watt electric blankets and throw rugs are a cheaper way to keep warm than running her 2400W electric oil heater. Her Frewville townhouse has a reverse cycle air conditioner upstairs, which isn’t much good for heating the ground floor in winter.

Origin Energy, AGL Energy and Energy Australia have raised their South Australian retail prices by 7-15 per cent – as much as $260 a year on typical household bills of $1700-$2000 – and Ms Merran is bracing for news from her power company, Diamond Energy.

“I am really waiting with bated breath to see whether all the others will follow with a price increase,” she told The Australian Financial Review.

South Australia’s power crisis is starting to hit ordinary families as well as big employers like BHP Billiton, steelmaker Arrium and Port Pirie smelter owner Nyrstar – which forced the state government to lean on ENGIE to restart a mothballed gas turbine to ease skyrocketing wholesale prices last week.

Jo De Silva, senior policy officer with the South Australian Council of Social Service, worries that rising power bills hit her state harder than others because of its high unemployment. She said families will go without essentials like medicines and food to keep the lights on.

“There has definitely been more contact from consumers who are finding it hard to make ends meet and are quite alarmed about this latest round of price increases and what it’s going to mean for their household budgets,” Ms De Silva said.

Premier Jay Weatherill’s plunge into wind energy has forced coal generation out of South Australia, leaving the state at the mercy of gas generators like AGL Energy and ENGIE – and the Heywood high voltage lifeline to Victoria’s brown coal generators – when the wind drops.

But surging gas prices and Heywood’s outage for an upgrade have sent National Electricity Market (NEM) prices for South Australia soaring towards the $14,000 a megawatt hour NEM cap.

Since ENGIE re-booted the Pelican Point gas plant on Thursday, they’ve stayed at half to two-thirds above Victorian and NSW NEM prices.

For households like Ms Merran’s on a limited budget, it means turning down the thermostat on the power-hungry electric oil heater and finding other ways to make her power go further.

“If you are watching TV or sitting with a computer or a laptop it means the electric throw rug is the way to go, but it does mean the air is still cold,” she said.

Ms Merran, an energy efficiency adviser with a Uniting Church agency, and children Brannock, 13, and Matilda, 8, have been in the Frewville townhouse for about nine months and she is still figuring out how to make it draft-proof.

She pays her power bill directly from her mortgage offset account, so any extra means she is also paying more mortgage interest.

Last summer she checked the meter every day. The house needs door seals and curtains. “There are things I can do to make the house more energy efficient but those things cost money and take time. Curtains I can make but fabric is not free, so do I spend $200 on curtains and hope the savings come through to make it worthwhile? And how long will it take?”

The Weatherill government hasn’t conceded that its wind plunge is a problem. It wants federal subsidies for a new high voltage interconnector to NSW, costing up to $700 million.

Australian Financial Review

To those states like Victoria and Queensland and their obsessive desire to follow South Australia’s suicidal lead on wind power, as they say, ‘be careful what you wish for’. Welcome to your wind powered future.

wearing more blankets around the house.

Spot on as usual STT. As STT has pointed out, on numerous occasions, wind power can go from lots to absolutely nothing in a very short space of time, so that those so called experts who keep saying wind power just needs a bit of back up from time to time with open cycle gas turbines are once again totally misleading everyone (it was AGL’s master plan to get filthy rich quickly but apparently someone with a conscience scotched it) because those ocgt’s must be built, with infrastructure, to provide up to 100 % (more to keep the turbines running as well) capacity for total demand at any time ie. we consumers must pay for and maintain two ‘complete’ systems and apart from the exorbitant cost of wind power the cost of running a massive fleet of massive fast gas burning jet engines is astronomical. Never in Australia’s history has the collective intelligence of our decision makers been so low – no disrespect intended to those who have tried and tried to stop this almighty mess and to them we implore you to keep trying.

If the NSW politicians can hold their nerve, we citizens will be in clover. NSW doesn’t have a renewables target as we have “plenty of approved projects in the pipeline”. Queensland has committed to a 50% target for renewables by 2030, Victoria 40% by 2025, South Australia 50% by 2025 and the ACT, 100% by 2020.

The SA Government had to plead with the owners of a mothballed fossil fueled power station to restart it. Of course, the SA Government didn’t pay for this, which is politician speak for “we supplied the fuel”

And the SA politicians answer for this debacle: we need another interconnector so we can get reliable coal based grid power from NSW. Who is going to pay for that? The NSW electricity customers of course.

When Queensland and Victoria follow their SA counterparts and force their baseload generators into closure or bankruptcy, NSW will be sitting pretty. If we have any baseload to share, it will be pretty expensive. The ACT of course, doesn’t have any generators, baseload or otherwise.

Of course the ACT is not going to have anyone dirtying up their sand pit.