***

South Australia is an economic basket case, thanks, in no small part, to its obsession with wind power.

Power prices are spiralling out of control. Back in March SA’s businesses were belted with a 90% hike in their bills, that left manufacturers, miners and other power hungry businesses reeling: Wind Power Costs Crushing South Australian Businesses: Firms Hit with 90% Price Hike

Now residential customers have just been whacked by AGL, with a 12% power price hike (with a whole lot worse to come). What passes for journalism in SA pitched up the following half-baked ‘analysis’ on the causes of what portends to be a social and economic disaster (STT fills in the gaps a little later).

State’s largest energy retailer, AGL, set to hike electricity bill prices

The Advertiser

David Nankervis

15 June 2016

AGL customers will be hit by a big price hike.

THE state’s largest energy retailer, AGL, will slug its customers with an average annual hike of $228 on their electricity bill.

The 12 per cent price hike applies from next month and will have a massive impact as around half the state’s householders are AGL electricity customers.

The price hike has prompted urgent calls from welfare groups for householders to shop around for cheaper deals and save hundreds of dollars a year.

SA Council of Social Services executive director Ross Womersley said he was surprised at the price hike and didn’t understand the rationale behind it.

“No doubt this decision comes at an extraordinary time with householders having just seen savings in network charges of around $140 a year,” Mr Womersley said.

State Treasurer Tom Koutsantonis, himself an AGL customer, also urged customers to shop around. He said the price rise was unjustified and “a dramatic increase for South Australian families”.

In a statement issued this morning, AGL said the price rise was “mainly driven by the cost and availability of coal and gas supply for electricity generation as well as the changing mix of generation output”.

It added that the closure of the coal fired Port Augusta power stations “has contributed to the price changes”.

Opposition energy spokesman Dan van Holst Pellekaan blamed the Government’s promotion of renewable energy for the price rise.

“Labor’s flawed electricity policy led to the closure of the Port Augusta Power Station and now the Weatherill Government is proposing to spend hundreds of millions of taxpayers dollars upgrading an interconnector so it can import coal-generated electricity from Victoria,” he said.

AGL said the average weekly electricity bill increase would be $4.40 per week but this would vary “substantially depending on a customer’s tariff type, their usage, and their existing energy plan”.

The company also warned that new fees for over-the-counter payments and the issuing of paper bills would apply from October 2016.

The Advertiser

Treasurer Tom Koutsantonis says it’s time to shop around, so let’s see what’s on offer with the other retailers … well, let’s go shopping …

AGL and Origin both set to hike electricity bill prices

The Advertiser

David Nankervis

15 June 2016

Ouch! State’s largest power retailer to increase prices

ENERGY retailer Origin will increase electricity bills by 6.5 per cent or $117 a year.

The decision comes on top of AGL’s announcement on Wednesday of a 12 per cent — or $228 a year — increase for electricity as welfare agencies warned more retailers were likely to hike their prices.

Energy Australia refused to rule out price rises when contacted by The Advertiser.

But AGL gas customers will receive good news on Thursday when the retailer announces an average $100-a-year cut to gas bills.

The price rises from the state’s two biggest energy retailers take effect from next month.

St Vincent de Paul researcher Gavin Dufty said “all the retailers will change their prices”.

“You can guarantee the other companies will follow like pigs to a trough,” he said.

Uniting Communities spokesman Mark Henley said he “had no doubt the other retailers will be increasing their prices”.

The price hikes have prompted urgent calls from welfare groups for householders to shop around for cheaper deals to save hundreds of dollars a year.

SA Council of Social Services executive director Ross Womersley said he was surprised at the price hike and “didn’t understand the rationale” behind the increases.

“No doubt these decisions come at an extraordinary time with householders having just seen savings in network charges of around $140 a year,” Mr Womersley said.

Treasurer Tom Koutsantonis, himself an AGL customer, also urged customers to shop around and potentially save hundreds of dollars on their electricity bills.

He said the unjustified price rise “is a dramatic increase for South Australian families”.

AGL said the price rise was “mainly driven by the cost and availability of coal and gas supply for electricity generation as well as the changing mix of generation output”.

“The closure of the Port Augusta power station has contributed to the price changes.”

An Origin spokesman said “it’s important that we stay competitive while reflecting the costs we face as a retailer”.

Opposition energy spokesman Dan van Holst Pellekaan blamed the Government’s promotion of renewable power generation for the price rise.

“Minister Koutsantonis is busy blaming everyone else for high electricity prices, while Premier Weatherill continues to rush towards wind power driving cheap baseload out of the market,” Mr van Holst Pellekaan said.

“Labor’s flawed electricity policy led to the closure of the Port Augusta Power Station and now the Weatherill Government is proposing to spend hundreds of millions of taxpayers’ dollars upgrading an interconnector so it can import coal-generated electricity from Victoria.”

Mr Koutsantonis said the state Liberals “chose not to explore greater interconnection with eastern states when they privatised our power assets in 1999 and we are seeing the fruits of that decision today”.

Mr Henley called for a stakeholder energy summit to discuss how to reach the Government’s renewable energy targets at the cheapest cost.

AGL, which forecasts a $720 million profit this financial year, said it supported “a summit to discuss challenges facing the SA energy market”, while Mr Koutsantonis said he would consider a “cost-of-living summit”.

AGL said the average weekly electricity price increase would vary “substantially depending on a customer’s tariff type, their usage, and their existing energy plan”.

The company also foreshadowed new fees for over-the-counter payments and paper bills in October.

The Advertiser

OK, Tom so we ‘shopped around’ with AGL and Origin, the only other big retailer is Energy Australia, so let’s see what’s on offer there …

Energy Australia announces electricity price hike for South Australian customers

ABC News

Nicole Price

18 June 2016

A third electricity provider within a week has announced it is increasing its charges for South Australian customers.

Key points:

- Three energy companies announce price increases of between $117 and $260 a year

- Welfare agencies concerned as families struggle to pay bills

- Treasurer Tom Koutsantonis says people need to shop around for an energy provider

Energy Australia has followed in the footsteps of AGL and Origin Energy, announcing a $22 increase on the average monthly bill, or about an extra $260 a year, for customers in South Australia.

The average AGL bill will go up by about $230 a year and Origin customers will pay an extra $117 a year.

The companies have cited issues around coal and gas supply in South Australia as reasons, including the closure of the Port Augusta power station.

Energy Australia communications manager Mark Todd said the increase would begin from July 1.

“The main rationale for that is the rising cost of purchasing electricity on behalf of customers,” he said.

“That’s obviously not what customers want to hear. As a retailer we can play the blame game and blame factors beyond our control or we can try and do something about it.”

Mr Todd encouraged customers to contact the company to talk about ways to “that we can offset or negate that $22-a-month increase”.

He also noted there had been increases in business costs that had been factored into the rise.

The rise in electricity bills comes as South Australia continues to have the worse unemployment rate in the nation with 6.9 per cent.

It also comes as welfare agencies warn low-income earners are struggling to make ends meet and pay for the basics like electricity.

Earlier this week, Treasurer Tom Koutsantonis told South Australians to shop around for an energy provider.

The Opposition blamed the State Government’s renewable energy policies for the hikes.

ABC News

***

That’s 3 from 3 Tom! So what now?

Here’s ‘what now?’

South Australians are victims of a band of economic illiterates and useful political idiots, who bent over backwards to help the wind industry to roll out 1,477MW of capacity at 17 wind farms across the State.

The debacle began in 2002, when the Labor government under Premier, Mike Rann jumped into bed with a bunch of criminals, chancers and shysters from Babcock and Brown aka ‘Infigen’ (see our post here), which saw South Australia lead the charge on wind power and earn the (now infamous) nickname ‘Australia’s wind power capital’.

STT has been laying out the numbers for a couple of years now, based on which we have predicted (with chilling accuracy, so far) that South Australians can expect their power prices to double from here.

Already suffering the highest power prices in the nation – the future spot price is double neighbouring Victoria’s (see above) – SA’s ludicrous attempt to rely on sunshine and breezes is literally killing manufacturers, mineral processors and miners; and, with some 50,000 homes already disconnected from the grid, will punish thousands more families and households (particularly pensioners and the fast escalating number of unemployed).

SA Council of Social Services executive director Ross Womersley reckons he’s “surprised at the price hike and didn’t understand the rationale behind it”. Ross should get out more (starting with a visit to STT).

The only protagonist in the dismal saga laid out above that even comes close to identifying the elephant in the room is State Liberal, Dan van Holst Pellekaan – a towering Dutchman (by descent) with a background in economics. Dan gets pretty close to the mark with his observations that:

“the State’s Labor Government’s promotion of renewable power generation for the price rise. Minister Koutsantonis is busy blaming everyone else for high electricity prices, while Premier Weatherill continues to rush towards wind power driving cheap baseload out of the market”

“Labor’s flawed electricity policy led to the closure of the Port Augusta Power Station and now the Weatherill Government is proposing to spend hundreds of millions of taxpayers’ dollars upgrading an interconnector so it can import coal-generated electricity from Victoria.”

Dan is on the money when he points to Labor’s suicidal penchant for wind power helping to drive SA’s retail power prices through the roof (as noted above, it was Labor that set up South Australia’s wind power fiasco and along the way rewrote planning rules and noise guidelines to suit their wind industry paymasters).

Dan also hits the target when he says that “flawed electricity policy” is “driving cheap baseload out of the market” and “led to the closure of the Port Augusta Power Station” (until recently, the jewel in SA’s power generation crown).

However, Dan hasn’t quite got to grips with the fact that it is Federal Government policy that is the real villain behind South Australia’s wind powered economic disaster.

the villain that killed Port Augusta’s baseload plant.

***

STT has set it out before and, for the benefit of Dan (Ross Womersley and SA’s media hacks, who continue to struggle with the reasons behind SA’s rocketing retail power prices) we’ll set it out again.

What SA Pays when the Wind is Blowing

The villain that Dan van Holst Pellekaan had trouble naming is the Large-Scale Renewable Energy Target (LRET), which his fellow Federal Liberals know is doomed, but can’t bring themselves to say so out loud (see our post here).

As to how the LRET has wrecked SA’s power market, we’ll start with an observation by the Australian Financial Review’s Mark Lawson about how SA’s wind power outfits operate under the LRET:

When the wind is blowing strongly wind farm power will flood the market to pull prices down to minus $20 (generators pay retailers to take the power). This is obviously uneconomic for conventional generators, but wind and solar generators can still make some money under the renewable energy target.

In short, wind power outfits collect the same amount of revenue, irrespective of the spot price. However, conventional generators receive the prevailing price – and, unlike wind power outfits, do not receive any form of subsidy for what they dispatch: the market perversion driven by the LRET and subsidies for wind power is what has caused SA’s conventional generators to become unprofitable; and it’s that lack of profitability that led to Alinta’s decision to close its Port Augusta plant.

The Power Purchase Agreements (PPAs) struck between wind power outfits and retailers (which you’ll never once see the likes of Infigen or Trustpower talk about publicly) are built around the massive stream of subsidies established by the Large-Scale Renewable Energy Target (LRET) – which is directed to wind power generators in the form of Renewable Energy Certificates (RECs aka LGCs).

Under PPAs, the prices set guarantee a return to the generator of between $90 to $120 per MWh for every MWh delivered to the grid.

In a 2014 company report, AGL (in its capacity as a wind power retailer) complained about the fact that it is bound to pay $112 per MWh under PPAs with wind power generators: these PPAs run for at least 15 years and many run for 25 years.

Wind power generators can and do (happily) dispatch power to the grid at prices approaching zero – when the wind is blowing and wind power output is high; at night-time, when demand is low, wind power generators will even pay the grid manager to take their power (ie the dispatch price becomes negative)(see our post here). As noted in the quote from the AFR, wind power outfits have been paying the grid operator up to $20 per MWh to take power with no commercial value.

However, the retailer still pays the wind power generator the same guaranteed price under their PPA – irrespective of the dispatch price: in AGL’s case, $112 per MWh.

PPA prices are 3-4 times the cost that retailers pay to conventional generators; retailers can purchase coal-fired power from Victoria’s Latrobe Valley for around $25-35 per MWh.

Underlying the PPA is the value of the RECs (aka LGCs) that are issued to wind power generators and handed to retailers as part of the deal.

The issue and transfer of RECs under the LRET sets up the greatest government mandated wealth transfer seen in Australian history: the LRET is – without a shadow of a doubt – the largest industry subsidy scheme in the history of the Commonwealth. That transfer – which comes at the expense of the poorest and most vulnerable; struggling businesses; and cash-strapped families – is effected by the issue, sale and surrender of RECs. As Origin Energy chief executive Grant King correctly puts it:

“[T]he subsidy is the REC, and the REC certificate is acquitted at the retail level and is included in the retail price of electricity”.

It’s power consumers that get lumped with the “retail price of electricity” and, therefore, the cost of the REC Subsidy paid to wind power outfits. The REC Tax/Subsidy has already added over $10 billion to Australian power bills, so far.

Between 2016 and 2031, the mandatory LRET requires power consumers to pay the cost of issuing 470 million RECs to wind power generators. With the REC price currently $82 – and tipped to exceed $90 as retailers get hit with the shortfall penalty set by the LRET – the wealth transfer from power consumers to the Federal Government (as retailer penalties) and/or to the wind industry (as REC Subsidy) will be somewhere between $40 billion and $50 billion, over the next 16 years:

What Kills the Australian Wind Industry: A $45 Billion Federal Power Tax

With more wind power capacity per head than any other State, South Australians are going to be lumbered with a disproportionate share of the ludicrous cost of the REC Tax/Subsidy, set by the LRET.

A cost that is already forcing major employers like Nyrstar to consider shutting up shop – with the immediate loss of 750 jobs in economically depressed Port Pirie. And more than 50,000 SA homes to do without any power at all, now (see our post here). And, which is one half of the reason why South Australians are being belted with power price increases that are 4-5 times the rate of inflation. Here’s the other half.

What SA Pays when the Wind Stops Blowing

SA’s has 17 wind farms; with a ‘notional’ installed capacity of 1,477MW – it has the greatest number of turbines per capita of all States – and the highest proportion of its generating capacity in wind power by a country mile.

The chaos that wind power brings with it, has created the perfect opportunity for peaking power operators (running highly inefficient Open Cycle Gas Turbines and diesel generators) to make out like bandits at power consumers’ expense – simply because it can be predictably ‘relied’ on to disappear without warning (see above).

Wind power driven, market chaos clearly has the Australian Energy Market Operator worried; and, if SA’s journalists were on the ball, should have policy makers anxious and voters/power consumers furious.

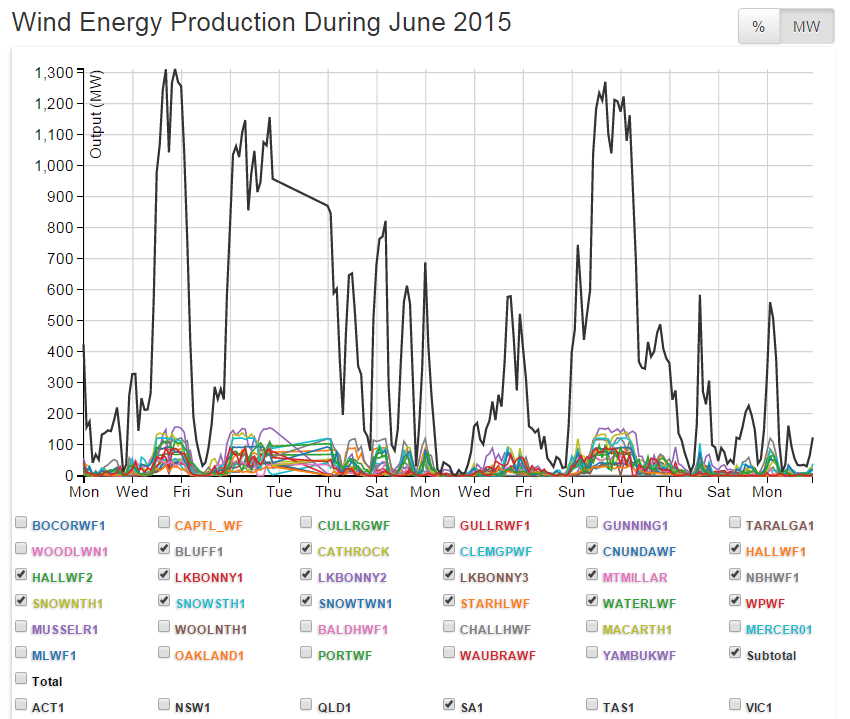

To detail what we mean we’ll pick up on an AEMO analysis of SA’s spot market. The following comes from AEMO’s ‘Pricing Event Report’ for SA for July 2015. To which we’ve added daily output data, care of Aneroid Energy. (noting that with Port Augusta out of the game, the phenomenal price spikes set out below will occur even more regularly, from here on)

In 2015, SA’s average spot price for power was running around $72 per MWh (compared to Victoria’s $35 – for the future spot price margin for next year and beyond, see above). The reason for the price difference has a lot to do with the fact that the Victorians have a relatively tiny proportion of their generating capacity in wind power; and the largest coal-fired generators in the country.

Now, with SA’s 2015 average of $72 per MWh in mind, consider the number of occasions in July when – as wind power output collapses – the spot price approaches or hits the Market Price Cap. That cap – currently $13,800 per MWh – sets the upper limit of what peaking power generators can extort from the system: for a rundown on how the National Energy Market is designed to work, see this paper: AEMO Fact Sheet National Electricity Market

That’s the ‘design’; here’s the shocking reality.

Pricing Event Reports – July 2015

Electricity Pricing Event Report – Tuesday 28 July 2015 (TI ending 1830 hrs)

Market Outcomes: South Australian spot price reached $1,967.51/MWh for trading interval (TI) ending 1830 hrs.

South Australian FCAS prices (Volume Weighted FCAS Prices) and energy and FCAS prices for the other NEM regions were not affected by this event.

South Australia had an actual Lack of Reserve 1 (LOR1) from 1800 hrs to 2030 hrs (Market Notices 49437 and 49438).

Detailed Analysis: 5-Minute dispatch price reached $10,759.20/MWh for dispatch interval (DI) ending 1820 hrs. The high price can be attributed to rebidding of generation capacity and limited interconnector flows during the evening peak demand period. Wind generation was low during this period in South Australia.

The South Australian demand was 2,233 MW for TI ending 1830 hrs. During the same TI, wind generation in South Australia was at 18 MW.

For DI ending 1820 hrs, a total of 38 MW of generation capacity was rebid from Hallett PS and Northern PS unit 2 from bands priced at or below $590.07/MWh to bands priced above $13,333/MWh. South Australian generation capacity was offered at less than $591/MWh or above $10,759/MWh resulting in a steep supply curve.

Cheaper priced generation were restricted by their ramp rates (Mintaro GT) and FCAS profiles (Torrens Island A units 3 and 4). Generation offers at $10,759.20/MWh had to be cleared from Dry Creek GT unit 3 to meet the demand for the DI.

During the affected DI, the target flow towards South Australia on the Heywood interconnector was constrained to 403 MW by an outage constraint equation V::S_XKHTB1+2_MAXG. This transient stability constraint equation manages the Victoria to South Australia flow for the loss of the largest generation block in South Australia during the outage of both parallel Keith – Tailem Bend 132 kV lines.

The target flow on the Murraylink interconnector was limited to 68 MW towards South Australia by the outage constraint equation, V>X_NWCB6022+6023_T1. This constraint equation limits flow from Victoria to South Australia on Murraylink during the planned outage of the Monash – North West Bend No. 2 132 kV line from 22 July 2015.

The 5-minute price reduced to $104.27/MWh in the subsequent DI to the high priced interval when 673 MW of generation capacity was rebid from higher priced bands to the market floor price of -$1,000/MWh.

The high 30-minute spot price for South Australia was forecast in pre-dispatch schedules prior to TI ending 1130 hrs. The pre-dispatch schedule for TI ending 1830 hrs forecast a spot price of $590.07/MWh. The difference in prices between Pre-dispatch and Dispatch was a result of rebidding of generation capacity within the affected trading interval. The wind generation forecast for pre-dispatch was also marginally higher, which also contributed to the difference in prices.

Electricity Pricing Event Report – Tuesday 28 July 2015

Market Outcomes: South Australian spot price reached $2,390.06/MWh for trading interval (TI) ending 0800 hrs.

South Australian FCAS prices and energy and FCAS prices for the other NEM regions were not affected by this event.

Detailed Analysis: 5-Minute dispatch price reached the Market Price Cap (MPC) of $13,800/MWh in South Australia for dispatch interval (DI) ending 0750 hrs. The high price can be attributed to rebidding of generation capacity resulting in a steep supply curve during the morning peak demand period. Wind generation was low during this period in South Australia.

The South Australian demand was 1,915 MW for TI ending 0800 hrs. During the high priced TI, wind generation in South Australia was at 19 MW.

For DI ending 0750 hrs, AGL shifted a generation capacity of 160 MW from Torrens Island B PS from bands priced at or below $124.99/MWh to bands priced at MPC of $13,800/MWh. South Australian generation capacity was offered at less than $591/MWh or above $12,195/MWh resulting in a steep supply curve.

Cheaper priced generation were restricted by their ramp rates (Hallett PS, Mintaro GT, Quarantine PS unit 4) and fast-start profiles (Dry Creek GT unit 3) which required time to synchronise.

Generation offers at Market Price Cap (MPC) of $13,800/MWh had to be cleared from Torrens Island B PS to meet the demand for the DI.

During the affected DI, the target flow towards South Australia on the Heywood interconnector was constrained to 460 MW by the Victoria to South Australia Heywood upper transfer limit thermal constraint equation, V>S_460. The target flow on the Murraylink interconnector was limited to 61 MW towards South Australia by the outage constraint equation, V>X_NWCB6022+6023_T1. This constraint equation limits flow from Victoria to South Australia on Murraylink during the planned outage of the Monash – North West Bend No. 2 132 kV line from 22 July 2015.

The 5-minute price reduced to $109.32/MWh in the subsequent DI to the high priced interval when South Australia demand reduced by 77 MW. Approximately 101 MW of non-scheduled generation came online. Generation capacity was also rebid from higher price bands to the market floor price of -$1000/MWh which also contributed to reducing the dispatch price.

The high 30-minute spot price for South Australia was not forecast in the pre-dispatch schedules, as it was a result of rebidding of generation capacity within the affected trading interval. The wind generation forecast for pre-dispatch was also marginally higher, which also contributed to the difference in prices between pre-dispatch and Dispatch.

Electricity Pricing Event Report – Monday 27 July 2015

Market Outcomes: South Australian spot price reached $4,449.17/MWh for trading interval (TI) ending 0800 hrs.

South Australian FCAS prices and energy and FCAS prices for the other NEM regions were not affected by this event.

Detailed Analysis: 5-Minute dispatch price reached the Market Price Cap (MPC) of $13,800/MWh and $12,195.07/MWh in South Australia for dispatch intervals (DIs) ending 0755 hrs and 0800 hrs respectively.

The high prices can be attributed to rebidding of generation capacity resulting in a steep supply curve during the morning peak demand period. Wind generation was moderately low during this period in South Australia.

The South Australian demand was 1,896 MW and the temperature in Adelaide was 4.9 °C for TI ending 0800 hrs. During the high priced TI, wind generation in South Australia was at 141 MW.

For DI ending 0755 hrs, AGL shifted a generation capacity of 200 MW from Torrens Island B PS from bands priced at or below $174.99/MWh to bands priced at MPC setting the high price. South Australian generation capacity was offered at less than $591/MWh or above $10,759/MWh resulting in a steep supply curve.

Cheaper priced generation were restricted by their ramp rates (Hallett PS), FCAS profiles (Northern PS unit 2) and fast-start profiles (Dry Creek GT units 2 and 3) which required time to synchronise.

For DI ending 0800 hrs, cheaper priced generation were restricted by fast-start profiles (Dry Creek GT units 2 and 3) which required time to synchronise. Generation offers at $12,195.07/MWh had to be cleared from Hallett PS to meet the demand for the DI.

During the high priced DIs, the target flow on the Heywood interconnector was limited up to 418 MW towards South Australia by the binding transient stability constraint equations, V::S_NIL_MAXG_SECP and V::S_NIL_MAXG_AUTO. The V::S_NIL_MAXG_SECP constraint equation prevents transient instability by limiting flow on the Heywood interconnector from Victoria to South Australia for the loss of the largest generator in South Australia for periods when the South East capacitor is unavailable for switching. The V::S_NIL_MAXG_AUTO constraint equation prevents transient instability by limiting flow on the Heywood interconnector from Victoria to South Australia for the loss of the largest generation block in South Australia.

The target flow on the Murraylink interconnector was limited to 58 MW towards South Australia by the outage constraint equation, V>X_NWCB6022+6023_T1. This constraint equation limits flow from Victoria to South Australia on Murraylink during the planned outage of the Monash – North West Bend No. 2 132 kV line from 22 July 2015.

The 5-minute price reduced to $174.99/MWh in the subsequent DI to the high priced interval when generation capacity from several South Australian generators were shifted to lower priced bands.

The high 30-minute spot price for South Australia was not forecast in the pre-dispatch schedules, as it was a result of rebidding of generation capacity within the affected trading interval. The wind generation forecast for pre-dispatch was also marginally higher, which also contributed to the difference in prices between pre-dispatch and Dispatch.

Electricity Pricing Event Report – Wednesday 22 July 2015

Market Outcomes: South Australian spot price reached $2,296.07/MWh for trading interval (TI) ending 1830 hrs.

South Australian FCAS prices and energy and FCAS prices for the other NEM regions were not affected by this event.

Detailed Analysis: 5-Minute dispatch price reached $13,481.81/MWh in South Australia for dispatch interval (DI) ending 1810 hrs. The high price can be attributed to a steep supply curve of generation capacity offered during evening peak demand period when wind generation was low in South Australia.

The South Australian demand was 2,100 MW for TI ending 1830 hrs. During the high priced TI, wind generation in South Australia was low at 39 MW.

For DI ending 1805 hrs, Energy Australia shifted a generation capacity of 34 MW from Hallett PS from bands priced at $360.81/MWh to bands priced at $13,481.81/MWh. For DI ending 1810 hrs, AGL rebid a generation capacity of 100 MW from Torrens Island B PS from bands priced at or less $64.99/MWh to bands priced at $13,500/MWh. South Australian generation capacity was offered at less than $591/MWh or above $10,750/MWh resulting in a steep supply curve. Cheaper priced generation was restricted by FCAS profiles (Northern PS unit 2 and Torrens Island PS unit A4) and fast-start units (Mintaro PS and Quarantine PS) which required time to synchronise.

Generation offers at $13,481.81/MWh had to be cleared from Hallett PS to meet the demand for the DI.

The target flow on the Heywood interconnector was limited to 447 MW towards South Australia by the binding transient stability constraint equation, V::S_NIL_MAXG_AUTO. This constraint equation prevents transient instability by limiting flow on the Heywood interconnector from Victoria to South Australia for the loss of the largest generation block in South Australia. The target flow on the Murraylink interconnector was limited to 64 MW towards South Australia by the outage constraint equation, V>X_NWCB6022+6023_T1.

This constraint equation limits flow from Victoria to South Australia on Murraylink during the planned outage of the Monash – North West Bend No. 2 132 kV line from 22 July 2015.

The 5-minute price reduced to $53.42/MWh in the subsequent DI to the high priced interval. South Australia demand reduced by 103 MW when 101 MW of non-scheduled generation came online. Generation capacity was also rebid from higher price bands to the market floor price of -$1000/MWh which also contributed to reducing the dispatch price.

The high 30-minute spot price for South Australia was not forecast in the pre-dispatch schedules, as it was a result of rebidding of generation capacity within the affected trading interval. The wind generation forecast for pre-dispatch was also marginally higher, which also contributed to the difference in prices between pre-dispatch and Dispatch.

Electricity Pricing Event Report – Sunday 19 July 2015

Market Outcomes: South Australian spot price reached $2,372.11/MWh for trading interval (TI) ending 1830 hrs.

South Australian FCAS prices and energy and FCAS prices for the other NEM regions were not affected by this event.

Detailed Analysis: 5-Minute dispatch price in South Australia reached $13,333.95/MWh for dispatch interval (DI) ending 1830 hrs. The high price can be attributed to a steep supply curve in generation capacity during the evening peak demand period when wind generation was low in South Australia.

The South Australian demand was 2,066 MW for TI ending 1830 hrs. The high evening peak demand was due to the cool weather in Adelaide, with a low temperature of 7.3°C at 1830 hrs. During the high priced TI, wind generation in South Australia was low at 3 MW for TI ending 1830 hrs.

For DI ending 1825 hrs, Alinta Energy rebid 95 MW of Northern PS generation capacity from bands priced at or less than $286.95/MWh to $13,333.95/MWh. South Australian generation capacity was offered at less than $591/MWh or above $10,750/MWh resulting in a steep supply curve for the high priced DI. Cheaper priced generation were restricted by ramp rates (Torrens Island Unit A4), FCAS profiles (Northern PS Unit 2) or required time to synchronise (Hallett PS).

Generation offers at $13,333.95/MWh had to be cleared from Northern PS units to meet the demand for the DI.

The target flow on the Heywood interconnector was limited to 448 MW towards South Australia by the thermal constraint equation, V>S_NIL_HYTX_HYTX. This system normal thermal constraint equation manages post contingent flow on the Heywood 500/275 kV transformers by reducing Heywood interconnector flow when the actual flow exceeds the pre-defined transformer rating. The target flow on the Murraylink interconnector was limited to 64 MW towards South Australia by the outage constraint equation, V>X_NWCB6225+6021_T1. This constraint equation limits flow from Victoria to South Australia on Murraylink during the planned outage of the North West Bend 132 kV circuit breakers from 13 July 2015.

The 5-minute price reduced to $115.77/MWh in the DI subsequent to the high priced interval when demand reduced by 111 MW and 101 MW of non-scheduled generation came online.

The high 30-minute spot price for South Australia was not forecast in the pre-dispatch schedules, as the forecast demand in pre-dispatch was lower.

Electricity Pricing Event Report – Friday 17 July 2015 (TI ending 0000 hrs on 18 July 2015): South Australia

Market Outcomes: South Australian spot price reached $2,256.25/MWh for trading interval (TI) ending 0000 hrs (on Saturday, 18 July 2015).

FCAS prices and energy prices for the other NEM regions were not affected by this event.

Detailed Analysis: 5-Minute dispatch price reached $13,333.95/MWh in South Australia for dispatch interval (DI) ending 2340 hrs on 17 July 2015 during high demand period due to hot water load management (ripple control). Between DIs ending 2325 hrs and 2340 hrs, the South Australian demand increased by 311 MW. This additional load represented an 18% increase in the South Australian demand.

Wind generation in South Australia was approximately 120 MW for TI ending 0000 hrs on 18 July 2015.

At DI ending 2335 hrs, a total of 150 MW of generation capacity from Northern PS was shifted from bands priced at or less than $286.95/MWh to $13,333.95/MWh. The high price for DI ending 2340 hrs was set by Northern PS at $13,333.95/MWh. Cheaper priced generation was available from fast-start units (Hallet and Dry Creek unit 3) which required time to synchronise.

The target flow on the Heywood interconnector was limited to 449 MW towards South Australia by a thermal constraint equation, V>S_NIL_HYTX_HYTX for DI ending 2340 hrs. This system normal constraint equation manages post contingent flow on the Heywood 275/500 kV transformers by reducing the Heywood interconnector flow when the actual flow exceeds the pre-defined transformer rating. The target flow on the Murraylink interconnector was limited to 66 MW towards South Australia by an outage constraint equation, V>X_NWCB6225+6021_T1. This constraint equation manages limits flow from Victoria to South Australia on Murraylink during the planned outage of the North West Bend 132 kV circuit breakers from 13 July 2015.

The 5-minute price reduced to $47.13/MWh for the next interval (DI ending 2345 hrs) when the demand reduced by approximately 122 MW and 102 MW of non-scheduled generation came online. A total of 349 MW of generation capacity was also rebid from higher priced bands to the market floor price of -$1,000/MWh.

The high 30-minute spot price for South Australia was not forecast in the pre-dispatch schedules, as it was a result of a 5-minute load increase that caused a price spike in the 5-minute dispatch prices.

Electricity Pricing Event Summary – Tuesday 7 July 2015*

Market Outcomes: South Australia spot price reached $1,221.54/MWh for trading interval (TI) ending 1900 hrs. South Australia FCAS prices and energy and FCAS prices in other regions were not affected.

Summary:

South Australia 5-Minute dispatch price reached $6,794.04/MWh for dispatch interval (DI) ending 1855 hrs due to a steep supply curve in generation capacity during a period of low wind generation. Planned outages affecting the interconnector flow into South Australia also contributed to the high price.

- Low levels of wind generation in South Australia at approximately 60 MW at TI ending 1900 hrs

- Rebidding of 20 MW of Hallett PS generation capacity from bands priced at or less than $360.81/MWh to bands priced at $13,481.81/MWh for DI ending 1840 hrs

- For DI ending 1855 hrs, South Australian generation capacity was offered at less than $590/MWh or above $10,750/MWh resulting in a steep supply curve

- Cheaper priced generation were restricted by a fast-start unit (Dry Creek GT unit 3) which required time to synchronise

- The target flow on the Heywood interconnector was limited to 430 MW towards South Australia by a planned outage thermal constraint equation, V>S_APHY2_NIL_HYTX2. This constraint equation manages flow of the Heywood M2 transformer during the outage of APD-HYTS No. 2 500 kV line

- The target flow on the Murraylink interconnector was limited to 181 MW towards South Australia by a planned outage constraint equation, S>>RBTX1_RBTX2_WEWT. This constraint equation manages post contingent flow of Waterloo East – Waterloo 132 kV line for the trip of Robertstown No. 2 132/275 kV transformer during the outage of Robertstown No. 1 132/275 kV transformer.

South Australia energy price reduced to $46.14/MWh for DI ending 1900 hrs when:

- Demand reduced by 144 MW and 104 MW of non-scheduled generation came online

- Generation capacity was rebid from higher price bands to the market floor price of -$1000/MWh which also contributed to reducing the dispatch price.

The high 30-minute spot price for South Australia was not forecast in the pre-dispatch schedules, as the forecast demand in pre-dispatch was lower.

* A summary was prepared as the maximum daily spot price was between $500/MWh and $2,000/MWh

Electricity Pricing Event Report – Friday 03 July 2015

Market Outcomes: South Australian spot price reached $2,296.32/MWh for trading interval (TI) ending 0830 hrs.

South Australian FCAS prices and energy and FCAS prices for the other NEM regions were not affected by this event.

Detailed Analysis: 5-Minute dispatch price reached $13,333.95/MWh in South Australia for dispatch interval (DI) ending 0810 hrs. The high price can be attributed to a steep supply curve of generation capacity offered during morning peak demand period when wind generation was low in South Australia.

The South Australian demand was 1,990 MW for TI ending 0830 hrs. The high morning peak demand was due to the cool weather in Adelaide, with a low temperature of 3.5 °C at 0800 hrs gradually rising to 6.5°C at 0900 hrs at Adelaide Airport. During the high priced TI, wind generation in South Australia was low at 45 MW for TI ending 0830 hrs.

For DI ending 0810 hrs, South Australian generation capacity was offered at less than $590/MWh or above $10,750/MWh resulting in a steep supply curve. Cheaper priced generation were restricted by a fast-start unit (Hallett PS) which required time to synchronise.

Generation offers at $13,333.95/MWh had to be cleared from Northern PS units to meet the demand for the DI.

The target flow on the Heywood interconnector was limited to 444 MW towards South Australia by the binding thermal constraint equation, V>S_NIL_HYTX_HYTX. This system normal thermal constraint equation manages post contingent flow on the Heywood 275/500 kV transformers by reducing Heywood interconnector flow when the actual flow exceeds the pre-defined transformer rating. The target flow on the Murraylink interconnector was limited to 179 MW towards South Australia by a voltage stability constraint equation, V^SML_NSWRB_2. This constraint equation avoids voltage collapse in Victoria for loss of the Darlington Point to Buronga (X5) 220 kV line.

The 5-minute price reduced to $103.93/MWh in the subsequent DI to the high priced interval. South Australia demand reduced by 96 MW when 105 MW of non-scheduled generation came online. Generation capacity was also rebid from higher price bands to the market floor price of -$1000/MWh which also contributed to reducing the dispatch price.

The high 30-minute spot price for South Australia was not forecast in the pre-dispatch schedules, as the forecast demand in pre-dispatch was lower. The wind generation forecast for pre-dispatch was also marginally higher, which also contributed to the difference in prices between pre-dispatch and Dispatch.

AEMO July 2015

So, in a nutshell: South Australians are paying a minimum of around $110 per MWh for wind power when the wind is blowing (compared with the Victorian average spot price of around $45); and, when the wind stops blowing, are paying a spot price that quickly hits $2,000 per MWh and often hits the cap of $13,800.

It’s an economic and social nightmare that any sane politician would be bursting to escape from. But, not in SA. Its Labor government, headed by the vapid Jay Weatherill only wants more of the same: pushing for a 50% RET. And among its hapless Liberal opposition the only one of their number to mutter so much as a peep is Dan van Holst Pellekaan.

If anyone is unsure how a wind powered ‘future’ might look, then look no further than South Australia.

Way back in 1960, I used to have a friend, whose parents had a farm, a few miles out of town (Jamieson, Victoria). The farm was too far away from the”Electricity” lines, so they relied on a single cylinder Lister deisel engine for their power. They also had “Windmills” to pump water from their dam to the milking shed, house and water the stock.

Quite often on weekends when the wind wasn’t blowing, we would have to move the Lister diesel down to the dam to pump the water to the house and the stock. These wind mills weren’t fit for anything else because they were “Unreliable” then and nothing has changed since 1960.

And the “Greens” call these “Bird Chompers” Renewables? New Technology?

You have to be kidding.

Reblogged this on Climatism and commented:

Unaffordable, inefficient, intermittent, unwanted, ‘Unreliables’!

As usual it is the less well off that are forced to take the brunt of the price hikes. Pollies and those benefiting can afford the higher prices with ease as many receive govt allowances for cost of living etc as well as being paid well beyond their worth. They will not act until people finally wake up to how bad Labor really is for them and take to the streets in civil disobedience. Unfortunately it will be a little too late then. The key to all this seems to be in exposing this dreadful fraud far and wide but so many private and unconscionable interests depend on the public at large remaining ignorant and believing against all the evidence that wind turbines are a ‘good thing’. Anyone noticed how difficult it is to get a letter re wind turbine fiasco printed in the press these days?

Excellent work by STT once again setting out the ‘facts’ clearly for those prepared to listen — it seems almost impossible,however, to penetrate through the rock hard ‘fantasies ‘ of the the political and chattering classes in South Australia.