Even the proles have worked out that wind and solar aren’t cheap, they aren’t clean and they most certainly aren’t green.

Their rocketing power bills are enough evidence to dispose of the ‘cheap’ wind and solar myth. Millions of tonnes of spent solar panels and toxic wind turbine blades being ground up and heading to landfills are sufficient to dispose of the clean and green myth.

Add to that the massive and ever-increasing subsidies to intermittent wind and solar and the big renewable energy lie is laid bare – as David Pearl outlines in the first piece. And Alan Moran confirms in the second.

The big renewable energy lie

The Spectator

David Pearl

8 June 2024

Always be suspicious of an expert report that appears to serve a crude ideological purpose. Always be on the lookout for the big lie dressed up in the language of science.

On May 22, the CSIRO’s latest GenCost report was released. It claimed that large-scale wind and solar are the lowest-cost electricity generation technologies, significantly under-cutting nuclear power alternatives. Chris Bowen was quick to seize on this: ‘Our reliable renewables plan is backed by experts to deliver the lowest cost energy,’ he said, on the day of its release.

Debate on the GenCost report has focused on its treatment of nuclear power. But commentators have missed a fatal flaw in the report’s methodology. Its reliance on a cost metric (the so-called Levelised Cost of Electricity or LCOE) that, by its authors’ own admission, is no ‘substitute’ for ‘more realistic’ ways to analyse electricity generation costs, including cash flow analysis.

Buried on page 64 of the report, this gives the game away. LCOE is an accounting metric, not an economic one. It measures the total unit costs a generator must recover to meet all expenses – plant, equipment, land, raw materials, and labour – including a return on investment. It says nothing about the revenue side of the commercial equation: What prices can the generator earn on the wholesale market and, given their costs, what profits can be earned?

For economists, nothing sensible can be said about a service’s economic value, and therefore economic cost, without this additional information.

Think about it. An unreliable car that costs far less to make than a reliable one could not be said to be ‘cheaper’ than the latter if it has no value for consumers. If, as is almost certain, it could not be sold at a profit, society would be in fact worse (not better) off for devoting capital, land and labour to its production. It is value-subtracting from an economic point of view, not value-adding (unless any external benefits it brings outweigh them).

By the same logic, an inherently unreliable source of power, like solar or wind, cannot be said to be cheaper in an economic sense than a reliable source of power, regardless of how much it costs to supply when the sun is shining and the wind is blowing, which as we know is only 20 to 40 per cent of the time.

To make the same point in a different way. For the 60 to 80 per cent of the time when intermittent power cannot be supplied at any price, its economic cost can be said to be infinite.

As the eminent MIT economist Paul Joskow has pointed out, the LCOE metric ignores the decisive commercial advantage dispatchable power, in whatever form, enjoys over wind and solar generation.

An operator of a coal, gas, and indeed nuclear power facility can gear their operation to meet expected consumer demand as reflected in wholesale market prices. In contrast, for intermittent wind and solar, consumer demand can only ever be satisfied – and profits earned, leaving subsidies to one side – by accident. Literally as a quirk of prevailing weather conditions.

In this respect, wind and solar are more akin to agriculture than manufacturing, liable to suffer from gluts (when it is sunny and all solar capacity is operating), droughts (on cloudy or windless days), and mismatches (when it is windy at times when power demand is minimal). Intermittent revenues, absent guaranteed returns, are inherently unreliable.

When combined with the very high fixed capital costs of renewable projects, this fact explains why wind and solar developers need huge subsidies despite their very low marginal costs. Why, in the absence of this taxpayer support, large-scale wind and solar operators would go out of business.

The GenCost LCOE measure blinds us to this inconvenient truth. It asserts that wind and solar are cheap, but cannot explain the subsidies they need. On this ground alone, it should be rejected. From the public’s perspective – from the point of view of consumers – it obscures and indeed misleads rather than enlightens. A private business using this marketing trick would never get away with it, yet government ministers go uncriticised.

When the Australian economy was collapsing under the economic weight of protectionism in the late 20th Century, the Productivity Commission’s predecessor agencies courageously publicised the economic costs of this policy. At first these reports were ignored, as both the Coalition and Labor politicians proudly boasted of being protectionist (the term didn’t become a pejorative one until the 1970s), but eventually they were taken notice of and influenced policy.

Today, the same critical spotlight should be applied to the costs of wind and solar power, which include: 1. the direct cost of subsidies for them; 2. the system-wide costs – including transmission, storage and back-up dispatchable power – they impose (this would include the cost of subsidies to keep coal-fired power stations operating); 3. the uncompensated economic, social and environmental losses wind, solar, and new transmission lines are inflicting farmers and others living in regional communities (an unprecedented expropriation of property rights); and 4. the welfare costs of a more volatile and less reliable grid (given that additional storage, with current technologies, cannot smooth things over if the renewable share continues to rise).

This renewable energy audit should be embraced by all in the community, regardless of their views on climate change, Net Zero and the merits of nuclear energy. It should be demanded by not only the opposition, but all Labor people who worry about the mounting economic pain being caused by the government’s renewable-only crusade.

Of course, the renewable industrial complex – which reaches deep into the bureaucracy, corporate world, the media and our academic institutions – can be relied on to bitterly oppose such an exercise.

For them at least, this form of sunlight would not be the best form of disinfectant. Rather, it would lay bare the billions of dollars of rents a select few are extracting from the rest of the community, possibly the biggest deliberate transfer of wealth from low to high-income Australians we have ever seen.

The Spectator

Renewable energy subsidies undermine our economy

The Spectator

Alan Moran

5 June 2024

Australia has seen a 20-year downward trend in productivity. Many other nations have seen similar trends and the cause is common: burgeoning growth of government squeezing out productive investment and an unrelenting surge in regulations, especially and notably so in Australia, covering fossil fuel both in its extraction and in its domestic use.

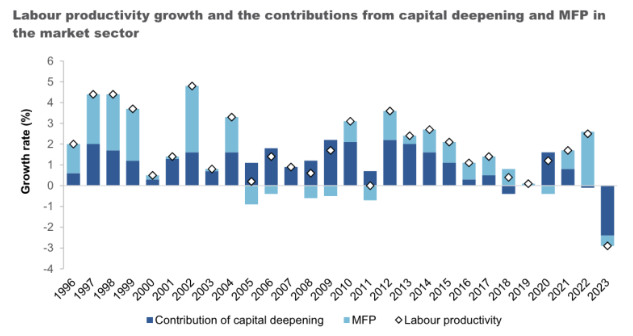

The Productivity Commission depicts the generally downward trend in productivity since the mid-1990s, punctuated by a mini recovery that petered out about a decade ago. In 2022-23 productivity actually fell by 3.7 per cent and remains below its 2021-22 level.

Australia has greater natural wealth per head of population than anywhere else in the world. With good government focused on protecting property rights, ensuring law and order, we would have the highest living standards in the world.

The fact that we are falling short – and increasingly so – of our potential is due entirely to government. The Commonwealth, over the past few decades, has increased its share of the nation’s spending from under 20 per cent to over 26 per cent of GDP and has run up half a trillion dollars of debt. We have seen similar increases from state governments – increases that have actually been accompanied by reduced service provision as a result of many former roles having been privatised.

An additional drag on real growth is regulation – the Institute of Public Affairs reports that the number of regulatory restrictions in federal law has increased by 88 per cent since 2005. Regulations have been exacerbated by judicial activism facilitating a well-financed green anti-development movement in preventing, delaying and seriously adding to costs and to investor confidence. Impediments to coal development are seen in all states. For gas, premium anticipated returns are now required for projects. This is a corollary of the travails like the dozen years it has taken Santos to get its Narrabri through a labyrinthian regulatory approvals system and the Victorian government’s layered moratorium on gas exploration.

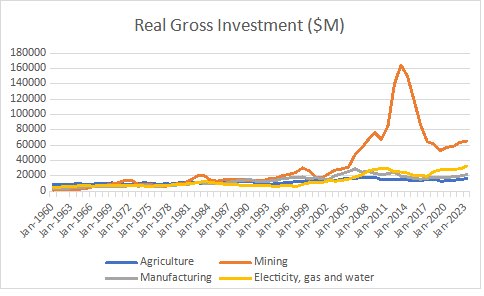

The dominance of mining in national investment, especially in the last 20 years, is evident, as is its collapse over the past 10 years.

Disturbingly, the age of the national capital stock has also increased over the past decade – in the case of manufacturing from 11 to 13 years; for mining from 7 to 10 years and for agriculture from 12 to 14 years. It can be of no consolation that the age of capital has not increased in the electricity, gas, and water sectors since a major component of that sector’s new capital is wind/solar electricity, which is highly subsidised and displaces far more productive coal generation, making apparent investment actual disinvestment.

Complementing the assault on mining are the progressively growing regulations that subsidise renewable energy.

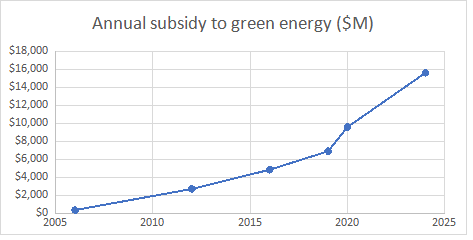

These regulations commenced with an obligation that retailers ensure ‘2 per cent of additional’ electricity to be provided by renewables, comprising wind and solar that then, as now, are both high cost and unreliable. Although no longer tabulated in the budget papers, the aggregate level of subsidy can be derived from published material. This shows from just a few hundred million dollars a year, the support for renewables is now over $15 billion a year.

The latest budget announced an upgrade in this support with $22.7 billion for Labor’s ‘Future Made in Australia’ agenda, much of which the Opposition has said it will retain.

These subsidies are, unlike other government direct spending and regulatory measures, actually designed to destroy one supply source, coal, and replace it with renewables. The increase in these subsidies bells the cat in claims that renewables are the cheapest form of electricity.

The subsidies have brought about a displacement of coal generation, which now provides about 56 per cent of electricity compared with 77 per cent historically. While initially bringing downward price pressures, the subsidies, in forcing coal generators’ closure and sub-optimal operations, have resulted in the ex-generator electricity price rising from under $40 per megawatt hour in 2015 to over $100 today. In addition, the diffuse and intermittent nature of wind and solar requires massive expenditures on duplicating back-up plant, batteries and a threefold expansion of the transmission network. And governments are now subsidising coal generators to prevent them closing ‘prematurely’ and thereby threatening the entire network.

This increased cost of electricity is already driving out businesses, especially the energy-intensive industries which have been the backbone of the nation’s productivity. And Barnaby Joyce asks, ‘Name me one global manufacturer who wants to move to Australia – just one. They’re all running for the door – aluminium, steel, plastics, oil refining, manufacturing, even food processing now with Cadbury.’

The Spectator

Subsidies don’t reduce costs. they hide them in your tax bill where politicians hope you won’t notice them. If you do happen to notice them, they natter about “the rich” paying “their fair share.” Maggie Thacher asked “What happens when you run out of other people’s money?”

excellent reading, love reading all your articles

Advice to people lodging objections. Seven general objections to all unreliable energy projects, wind, solar, batteries, pumped hydro.

Support the move to stop using the term renewables, just tell the truth and call them unreliables.

1 The ABC of intermittent energy.

The ABC explains that the transition to wind and solar power is impossible with current storage technology. Consequently we are approaching a tipping point when coal capacity runs down to the point where there is not be enough dispatchable capacity to meet demand on windless nights.

Attach file for the ABC and the link

https://newcatallaxy.blog/2023/07/11/approaching-the-tipping-point/

2 The human and environmental impact through all the stages from mining in remote places overseas to the disposal of toxic junk in local landfill

3 Protecting farmland. See Article 2 from the Paris Agreement in 2015.

This Agreement, in enhancing the implementation of the Convention, including its objective, aims to strengthen the global response to the threat of climate change, in the context of sustainable development and efforts to eradicate poverty, including by:

Increasing the ability to adapt to the adverse impacts of climate change and foster climate resilience and low greenhouse gas emissions development, in a manner that does not threaten food production;

That means no solar projects, no wind projects, no battery projects on rural land.

4 There is no business case for the unreliable energy providers in the absence of subsidies and mandates.

5 The rising cost of energy has driven many energy-intensive enterprises to the wall or overseas, with more to come.

6 National security is undermined by sourcing most of the expensive and unreliable energy infrastructure from a potentially hostile nation.

7 The opportunity cost, which is hardly ever mentioned. That is not the cost in dollars that just adds to the national debt. We don’t actually see that, it is just a number that gets bigger every month. The opportunity cost is all the useful things that we don’t get to see, things that we could have got for the same amount of money, like hospitals, schools, roads, bridges, disability services, police, military hardware etc.

Instead we spend tens of billions to get more expensive and less reliable energy with a tragic environmental impact from assets that will be stranded as soon as the subsidies and mandates stop.